Sometimes it pays to be invested in ASX-listed dividend-paying shares… literally. While a lull in dividend payments in 2020 left income investors shortchanged, this year is set to be a different story.

In the wake of the pandemic, dividends are beginning to resume, benefitting shareholders globally. However, ASX-listed companies are a true standout from the rest of the world. One expert asset manager now expects Australian dividend growth to be around 60% this year. Remarkably, this would be four times faster than the world overall.

The forecast was shared in the latest quarterly edition of the global dividend index published by global asset manager Janus Henderson Group CDI (ASX: JHG).

Let's break down why ASX dividend shares are expected to spruik world-beating profit-sharing this year.

A two part equation

While it might seem obvious why ASX investors are receiving plentiful dividends this year from our previous story, there's a bit more to it.

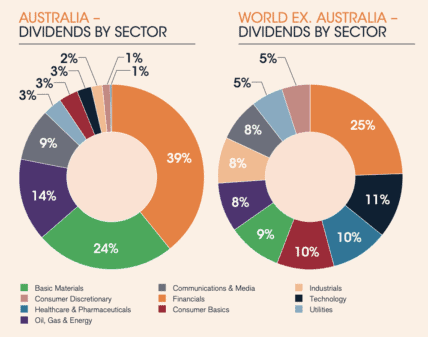

Yes, part of the reason is Australia's heavy weighting towards miners and banks — both of which have enjoyed a boom following the initial COVID-19 headwinds. For reference, 63% of Australia's dividends came from the financials and basic materials sectors year-to-date. Meanwhile, the rest of the world sourced only 34% of its dividends from these two sectors.

For Australia, this included substantial dividends from ASX shares such as BHP Group Ltd (ASX: BHP), Fortescue Metals Group Limited (ASX: FMG), and Commonwealth Bank of Australia (ASX: CBA).

Another contributing factor for Australia's expected 'rest of world' outperformance is based on where it came from. As mentioned by Janus Henderson, Australia is coming from a much lower point. In short, other parts of the world didn't cut their dividends as much last year. As a result, the growth year-on-year has been lower for those regions.

Nonetheless, ASX dividend investors cashed in on $41.9 billion in the third quarter. While it might not have been the largest amount from a country, we were the fastest-growing.