It is easy to forget about the humble dividend payment at times. Inconspicuously compounding wealth in the background while share price appreciation takes all the credit. Today, the dividend payouts from ASX shares are in focus as Australian dividends are found to be growing four times faster than the rest of the world.

The United States might take the win over Australia for growth, but the land down under has held its own as a dividend powerhouse. With a heavy weighting towards banks and miners, Australian year-to-date dividend growth has outpaced global performance.

Let's take a look at exactly what that means.

ASX share investors set for a $41.9 billion windfall

In the 32nd edition of the Janus Henderson (ASX: JHG) Global Dividend Index, the global asset manager unpacked the latest income investing trends. In the third quarter, 90% of companies globally either raised their dividends or held them steady.

However, the headline item is Australia's remarkable dividend growth compared to the prior corresponding period. According to the report, Australia's payouts increased by 126% on a headline basis, reaching a record-setting $41.9 billion. Comparatively, the payouts from the rest of the world only increased by 11.3%.

The finding highlights how influential the Australian economy has been in staging a COVID-19 comeback. More than a third of the $69 billion year-on-year increase in dividends came from Australian companies. Although, part of the sizeable increase in payments in Q3 is due to Australia's outsized dividend weakness last year.

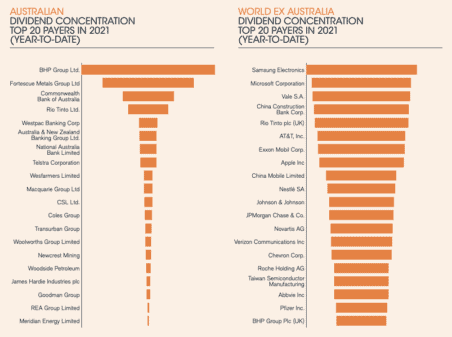

While the news is great for ASX dividend share investors, the uptick in payments was mostly thanks to miners and banks. In fact, Australian mining companies accounted for more than 60% of Australia's Q3 payouts. Moreover, three-quarters of mining companies in the Janus Henderson index at least doubled their dividend payments compared to Q3 2020.

Of those ASX dividend splurgers, BHP Group Ltd (ASX: BHP) will go down as the world's biggest dividend payer for 2021. Between the diversified miner's United Kingdom and Australian divisions, the company paid a collective $25.6 billion in dividends.

The disproportionate dividend growth from miners came amid soaring commodity prices as infrastructure took a front seat in rebuilding economies.

Similarly, Aussie banks increased shareholder payouts as prudential limits were lifted following lower-than-expected loan impairments. The Commonwealth Bank of Australia's (ASX: CBA) final dividend was within one-eighth of its pre-COVID level.

Looking ahead

Unfortunately, the team at Janus Henderson believes it's unlikely that mining companies will sustain the elevated payouts. Particularly given that some commodities have since fallen in value, such as iron ore.

For this reason, the asset manager considers miners to act as a headwind for dividend growth in the year to come. On the other hand, a driver for increased payouts for 2022 is likely to come from banks.

Lastly, the incredible strength in global and ASX dividend shares has led Janus Henderson to upgrade its full-year dividend forecast. The company now anticipates global growth of 15.6%, taking global payouts to a record $1.93 trillion.