The Deterra Royalties Ltd (ASX: DRR) share price is on the downtrend on Thursday.

At the time of writing, shares in the mining royalties company are 3.75% lower to $4.11. Today's further share price weakness puts Deterra 8.6% below where it was a month ago.

Iron ore tumbles from its top

For those unaware, Deterra hit the ASX in October 2020 after successfully conducting a demerger from Iluka Resources Limited (ASX: ILU). Unlike many other ASX-listed companies, the way Deterra makes money is quite simplistic. Rather than selling a product or a service, it collects revenue by holding royalties on various mining tenements.

Currently, Deterra holds royalties over 5 tenements with Mining Area C (MAC) being its biggest. This tenement is one of the four hubs within the BHP Group Ltd (ASX: BHP) Western Australian Iron Ore operations. As you can imagine — it had been a good year for the royalty company as it clipped the ticket on 61.6 million wet metric tonnes of iron ore at an average realised price of $200 per tonne. However, since the end of June 2021, iron ore prices have weakened.

To illustrate, iron ore prices have traversed a cliff that began at $214 at the end of June and is now perched at $143 per tonne. Based on some rudimentary calculations, that means the price is down 33.1% in the space of a couple of months.

Unsurprisingly, this has dealt a blow to the momentum in iron ore mining shares such as BHP and Fortescue Metals Group Limited (ASX: FMG) in recent weeks. Likely investors of Deterra are now taking a closer look at what the impact on prices could mean for them.

Calculating the impact

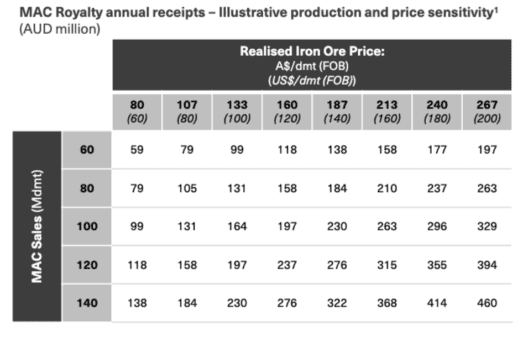

Conveniently, Deterra included a chart in its FY21 full-year results presentation for estimating royalty revenue. Keep in mind this is specifically for the Mining Area C royalty revenue.

Essentially, revenue is a function of iron ore sales and the realised iron ore price. As an exercise, let's run a hypothetical if output volume was to remain roughly the same but the realised price came down to ~$140 per tonne. In this case, Deterra's revenue would likely be somewhere around $105 million.

For reference, in FY21 Deterra pulled in $145.2 million in revenue and $94.3 million in net profit after tax.

Deterra share price recap

Since listing in October 2020, the Deterra share price has fallen 10.4%. In comparison, the S&P/ASX 200 Index (ASX: XJO) has rallied 21% over the same period.

On a side note, Deterra is paying a dividend yield of 3.4% based on its dividends paid during the last financial year.