The Webjet Limited (ASX: WEB) share price has been a clear winner over the past decade. Early investors have realised a healthy return on their investment.

We've done the math so you can see the returns for yourself.

Long-term horizon wins again

Investors who purchased Webjet shares at the quoted closing price of $1.21 on 5 August 2011 would have realised a healthy payoff, if holding until today.

To illustrate, let's assume we invested $2,000 on that day. That's roughly 1,653 Webjet shares on the book.

The first way we need to examine our return is simply through assessing capital gains.

Comparing the capital appreciation over the two periods, our Webjet position has exhibited a capital gain of around 312% over this time period.

Webjet share price performance last 10 years (to date)

Source: Google Finance

But what about dividends?

Next, we need to factor in the effect of dividends, to examine our total return. We will ignore the effect of dividend yield for purposes of simplicity.

Over the term in question, Webjet rewarded shareholders with $1.47 per share in cash via its dividend regime.

Factoring in dividends received, we've actually seen a total return of 433%, meaning our initial investment would now be worth around $8,250 and change.

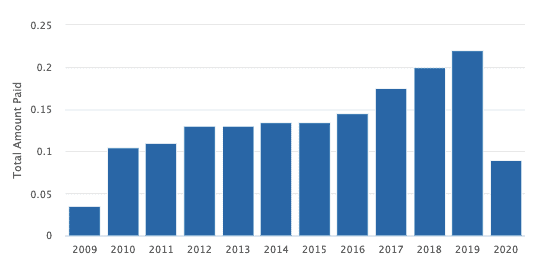

Webjet dividend payment history, 2009 – 2020 (current)

Source: The Motley Fool

Note the above calculations assume we can sell at the market price of $4.99 at the time of writing.

Some interesting outcomes arise if we make a few tweaks in our calculations. Let's assume we reinvested the dividends we earned on our hard-earned investment to buy more Webjet shares, at each semi-annual payment over the last 10 years.

Firstly, note Webjet's dividend has grown at a compound annual growth rate (CAGR) of 80% over our examination period.

As a result, this dividend reinvestment plan (DRIP) would have yielded a total return of 762%! Which is a meaningful spread above the S&P/ASX 200 Index (ASX: XJO)'s return over the same period.

Logically, this makes sense, as we are buying more shares which are going up in price over time. Carrying these assumptions through, this implies our position is now worth $15,240.

Long-term investing can pay off, given the right due diligence and patience, as evidenced by the Webjet share price.

Other factors to consider for the Webjet share price

The above scenario demonstrates the power of compounding, which has been labelled "the eighth wonder of the world" by experts across generations.

It reinforces the benefit of holding a long-term horizon when handling one's investments. This is especially true when considering purchasing a company's shares.

Webjet shares have also gained 75% over the last year as well. However, the Webjet share price has been hit hard by the Covid-19 pandemic this year.