This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

At first glance, the companies may seem very similar. Not only did they develop the first two COVID vaccines authorized by the Food and Drug Administration, they used messenger RNA (mRNA). It's a set of genetic instructions that direct cells to make proteins that trigger an immune response training your body for any future encounter. The technology had never been approved for a vaccine in humans. Yet, dig a little deeper and Moderna (NASDAQ: MRNA) and BioNTech (NASDAQ: BNTX) differ in important ways. They began differently, they are managed differently, and the path they are taking post-COVID is also diverging. So which one will make a better investment? A few clues offer a possible answer.1. Different companies from the beginning

Moderna went public in 2018 in what was to that point the largest biotech initial public offering (IPO) in history. It valued the company at $7.5 billion. To get there, it had to acquire the technology for delivering mRNA into cells via a license from a Canadian biotech. Despite a legal battle, the U.S. Patent and Trademark Office upheld the intellectual property claim last year. Although Moderna says its delivery technology has advanced far beyond the one it licensed, preclinical documentation submitted by the National Institutes of Health (NIH), and the company itself, may contradict that claim. It appears to describe a mechanism directly covered by the license. The story could be an unwelcome surprise for shareholders in the future. About a year later, BioNTech had its IPO. Far from the hype surrounding Moderna, BioNTech sold fewer shares than anticipated, and did so at a lower price than it expected. At the time, the company was valued at $3.4 billion. While Moderna CEO Stéphane Bancel has been labeled as brash, aggressive, and having an ego, BioNTech 's Uğur Şahin is described as holding meetings in jeans and carrying around a bike helmet and backpack. Pfizer CEO Albert Bourla has said of him, "he's a scientist and a man of principles. I trust him 100 percent." Those are just opinions, but sometimes it's all we have as individual investors.2. What gets prioritized gets done

Even before the SARS-CoV-2 virus was spreading around the globe, Moderna was focusing on vaccines. Bancel felt the one or two jabs for inoculation made it easier to deliver mRNA than a therapeutic. It was a business decision intended to mitigate the risk of any one failure. It's the type of calculated decision you would expect from someone who went to Harvard Business School. It turned out to be the reason the company was able to deliver a vaccine candidate so quickly. It had been working with the NIH on a drug to prevent a different coronavirus -- Middle East respiratory syndrome (MERS). It's just one of the viruses the company had been working on for years. BioNTech was much more focused. Its mission was to individualize cancer medicine. Its foray into the COVID-19 vaccine sweepstakes was an opportunistic gambit. On March 16, 2020 it announced it would initiate clinical testing on its vaccine candidate and the next day it introduced Pfizer as its partner. Aside from Comirnaty -- the name of the vaccine the partners ultimately developed -- its only non-cancer program with real progress is another venture with Pfizer. That drug is a vaccine for influenza. For most of their adult lives, Şahin and his wife -- the company's chief medical officer -- have been dedicated to research that to help defeat cancer.3. Wall Street shows one more love

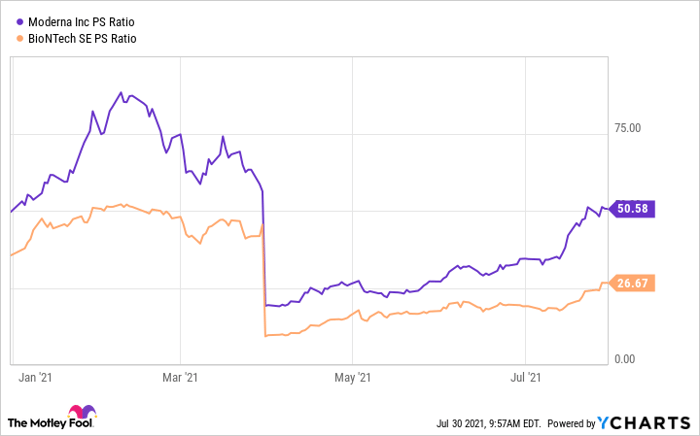

Despite the similarity in approach, Wall Street continues to value Moderna at nearly twice BioNTech. Although the latter has to share revenue with Pfizer, that doesn't account for the disparity in the sales multiple.

MRNA PS Ratio data by YCharts

Whether it's Moderna's broad ambitions, relationship with the NIH, large pipeline, or aggressive management, Wall Street clearly sees a difference.| Metric | Moderna | BioNTech |

|---|---|---|

| Market capitalization | $142.5 billion | $79.5 billion |

| 2021 estimated revenue | > $19.2 billion | > $14.7 billion |

| Estimated 2021 capacity | 800 million to 1 billion doses | 3 billion doses |

| Estimated 2022 capacity | Up to 3 billion doses | > 3 billion doses |

| Active clinical trials | 14 | 11 |

Data Sources: Moderna, BioNTech.

When Pfizer recently reported earnings, it upped its guidance for 2021 Comirnaty revenue from $26 billion to $33.5 billion. That should bode well for shareholders in BioNTech when it reports earnings in August. It jives with some analysts' projections for vaccine sales of $29 billion this year -- almost twice what the company has committed to.The tiebreaker

Both companies have done something truly remarkable by launching a vaccine within a year. Each is an innovator. And both Moderna and BioNTech are in excellent financial shape to fund the rest of their pipeline of mRNA drugs. Choosing between them is like ordering dessert -- there really isn't a wrong selection. That said, the tiebreaker for me is the owner mindset. I would rather invest in the understated focus of BioNTech and its leader than the more promotional head of Moderna. BioNTech was founded by Şahin and his wife. And despite seeing his net worth climb astronomically over the past year, he has yet to sell a share. Although Bancel might as well be a founder -- he was hired shortly after the company was created. He has taken advantage of the rising stock price in a way a founder may not have. In a report last year, it was revealed that the CEO had sold stock outside of normal processes when the company announced positive news. It netted him at least $40 million. No wrongdoing was alleged. He has every right to sell stock and diversify his net worth. It just highlights the difference between the two leaders. On some level, choosing between companies is answering the question "whom do you trust with your money?" For me, the answer is easy.This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.