This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Kudos to Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) for looking at opportunities beyond search engines and search-based advertising. YouTube and its cloud computing service arm have been smashing successes, driving at least some of the stock's gains in recent years. These businesses have also smoothed out potential revenue bumps from one quarter to the next. Just for the record, though, the company's biggest revenue-generating business is still search ... by far. Both Alphabet and its investors should ensure that this remains the focal point, even as it expands its presence in other areas.It's still all about search

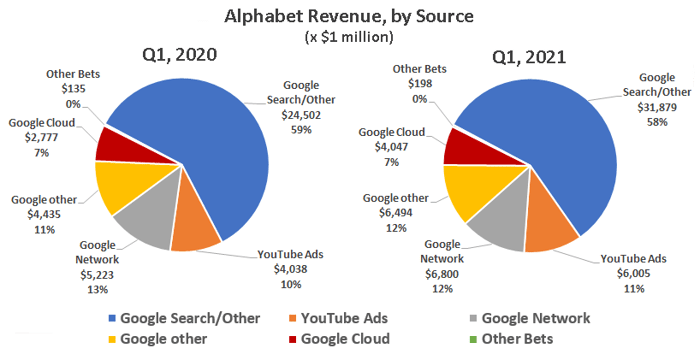

Don't misread the message: YouTube and Google Cloud are knocking it out of the park. The former's ad-based revenue jumped 48% year over year for the quarter ending in March, as the platform became a surprising destination for entertainment-starved consumers during the pandemic. As it turns out, people like access to a universe of short-form video content. Google's cloud-based revenue improved 46% during the same quarter, as corporations resumed their migration toward the much more flexible storage and computing format. Search ad revenue only improved 30% year over year for that three-month stretch. Keep things in perspective, though. Search still accounts for a little over 58% of Alphabet's revenue, down only slightly from its proportion in the first quarter of 2020. The pie charts below offer a visual summary of the company's revenue mix:

Data source: Alphabet. Charts by author.

Data source: Alphabet. Charts by author.

The bullish thesis stands, even if for a different reason

Many investors are surprised to learn just how minimally YouTube and Google Cloud affect Alphabet's fiscal results. That's the point of summarizing this reality in the simple graphics above. And to be fair, while both operating units are relatively small now, they're both growing nicely, and at a much faster clip than the company's traditional search advertising business. If you're a shareholder, though, this visual analysis also shows the importance of Alphabet's core business. The profits made on search and advertising helped fund the expansion of YouTube en route to self-sufficiency, and they are still funding the establishment of Alphabet's cloud computing operation. Investors will need some further evidence that the time, resources, and innovation put into the cloud segment of its operations is truly helping the bottom line if Alphabet is to remain the cash-cow juggernaut it currently is. This is just some food for thought. I believe the stock's still a buy either way.This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.