This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

Shares of Facebook (NASDAQ: FB) were climbing last month after the social media giant delivered a blowout earnings report at the end of the month. The stock also rose in early April along with the broader market in response to a number of bullish news reports.

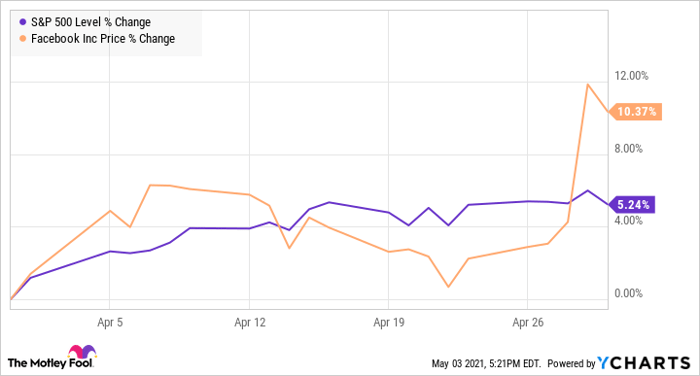

According to data from S&P Global Market Intelligence, the stock finished the month up 10%. As you can see from the chart below, shares spiked on April 29 after the earnings report came out.

So what

Facebook gained early in the month on news of Biden's infrastructure bill, a better-than-expected March jobs reports, and an accelerating vaccine rollout, before giving back much of those gains in the middle of the month.

On April 29, the stock jumped 7.3% in response to a strong earnings report.

Robust advertising demand drove revenue up 48% to $26.2 billion, well ahead of analyst estimates at $23.7 billion, and profits surged as the company lapped a weak performance in the quarter a year ago when lockdowns first hit. Operating income nearly doubled to $11.4 billion, and earnings per share came in at $3.30, easily beating expectations at $2.37.

The company is benefiting from a boom in digital advertising that drove a 30% increase in ad prices and has also seen solid growth in users thanks to the pandemic. Additionally, CEO Mark Zuckerberg said the company's Oculus AR/VR platform was reaching an inflection point as revenue in the "other" category, which is mostly made up of Oculus, jumped 146% to $732 million.

Now what

Facebook did not give specific guidance but called for second-quarter revenue growth to modestly accelerate from the first quarter as it laps the nadir of its performance a year ago. In the second half of the year, it sees revenue growth decelerating as comparisons will become more difficult and it faces headwinds related to changes in Apple's ad targeting policy, though the company said those wouldn't be as severe as once expected.

The stock now trades at a trailing price-to-earnings ratio of just 28, making the tech stock look significantly undervalued after the kind of quarter it just delivered.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.