Investors can take heart following the big bounce in our best-loved ASX technology shares last week, but more dark clouds are hovering on the horizon.

Some experts believe that bond yields are close to the point that would trigger a bear market collapse in the Nasdaq-100 (INDEXNASDAQ: NDX), reported Bloomberg.

A bear market is a peak-to-trough fall of at least 20%. And if the tech-ladened US share benchmark slumps, it will likely drag many top performing ASX tech shares into the red.

Best performing ASX tech shares more at risk

This ASX sector has delivered the best returns since COVID-19 triggered a market meltdown a year ago. In case you are wondering, there are around 40 ASX tech shares with a market cap of at least $100 million that have at least doubled in price over the period.

These including pocket rockets like the Ioupay Ltd (ASX: IOU) share price, the Pointerra Ltd (ASX: 3DP) share price and Cirralto Ltd (ASX: CRO) share price. These are the three top performers with gains of between 6,186% and 2,600%!

Of course, we can't forget the likes of the Afterpay Ltd (ASX: APT) share price and its other BNPL buddies either.

Bond yield trigger for tech bear market

But the stellar returns for tech shares could be undermined if the 10-year US government bond yield rises by as little as half a percentage point.

That's the assessment of Ned Davis Research, which was reported in Bloomberg. The research firm's model predicts that the Nasdaq 100 will fall by at least 20% if the US 10-year Treasury yield climbs to 2% this year.

The lift in the government bond yield will drive long-term Baa-rated corporate bonds to 4.5%. In such a scenario, the Nasdaq will have to fall 20% or more to stay attractive, all things being equal.

Venerable to vulnerable

Don't be fooled into thinking that the big bounce in share prices of technology shares in the US and Australia are a mitigating force to the bearish prediction.

Large single-day rallies are more common in a downtrend, according to Bloomberg. The start of the tech crash in 2000 recorded 27 sessions where the NASDAQ surged by at least 4% in a day.

This compared to just six in 1999 as the tech boom was accelerating.

Rotation from tech to value shares

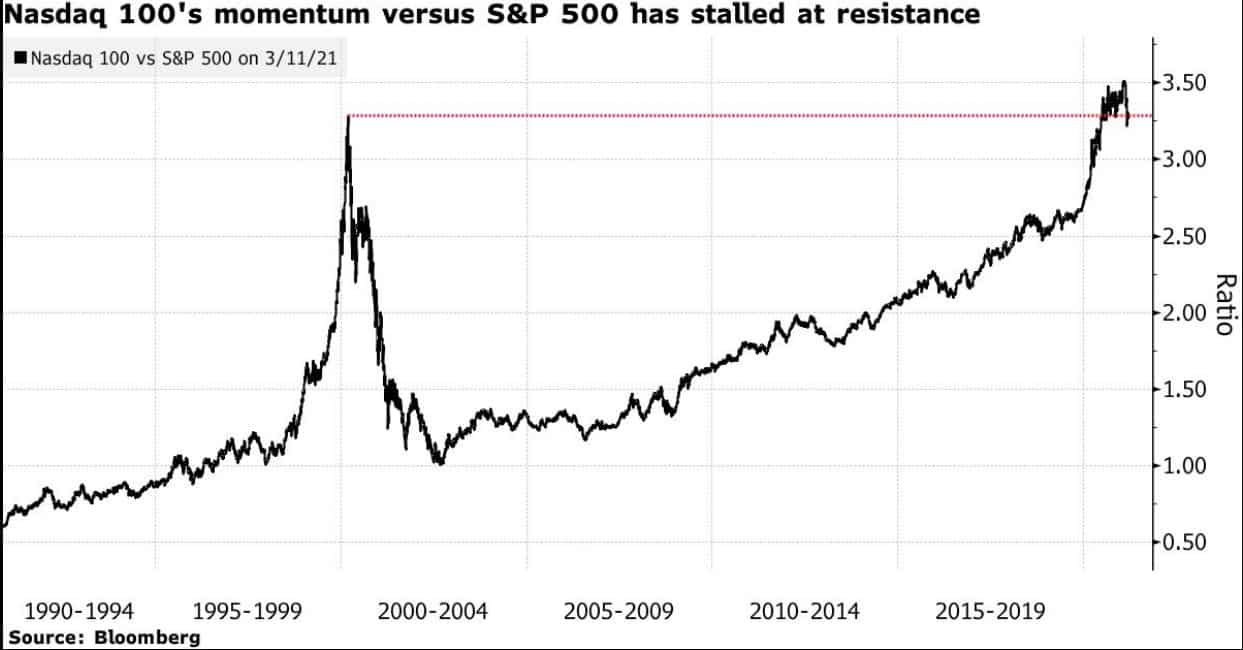

In another worrying sign, the performance gap between the Nasdaq 100 and the S&P 500 (INDEXSP: .INX) has exceeded that of the tech boom!

But what may be bad news for tech shares may be good news for the rest of the market. The S&P 500 didn't hit its record high until 14 months after the Nasdaq 100 tumbled in March 2000.