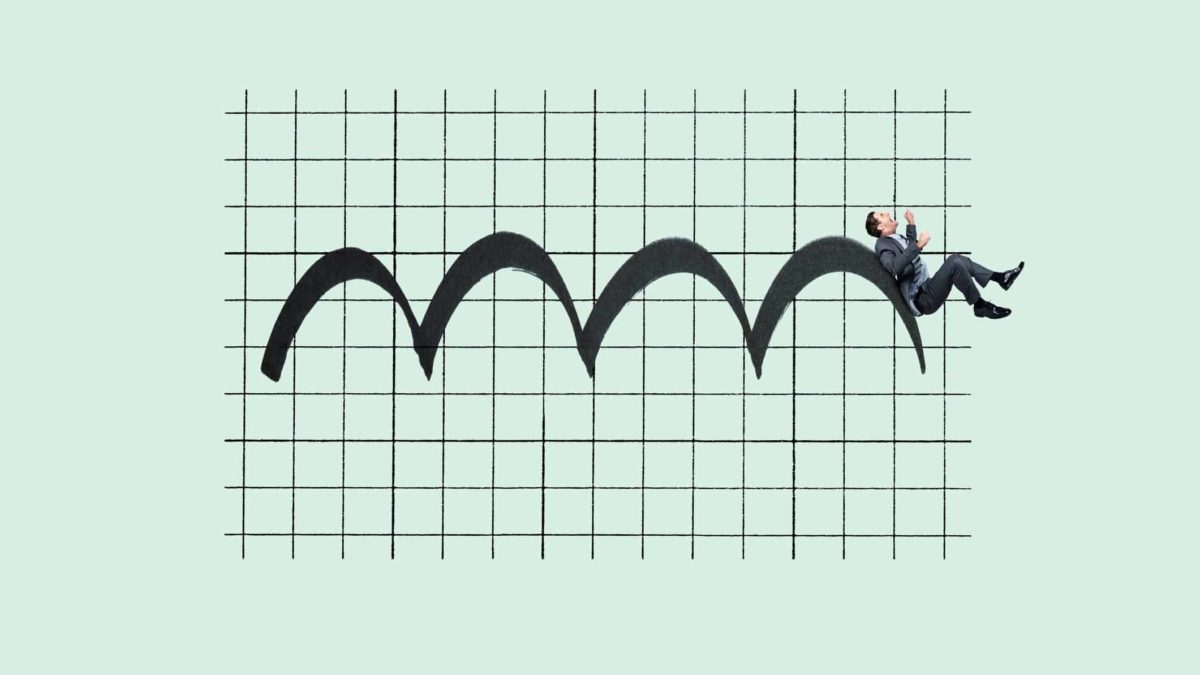

There is something freaky going on with Kogan.com Ltd (ASX: KGN) shares. Despite being a rare winner during COVID-19 lockdowns, the Kogan share price has nearly halved after hitting all-time highs in late 2020.

Since late January, Kogan shares have fallen by more than 38% after sinking 22% in February. At the time of writing, the Kogan share price is trading 1.9% higher for the day as the overall market bounces.

Let's take a look at what's been moving the Kogan share price.

What's been impacting the Kogan share price?

The initial catalyst that sparked a sell-off in Kogan shares can be traced to late January.

On 29 January, the online retailer released a business update for the first half of FY21. For the six months ending 31 December, Kogan reported a 96% increase in gross sales over the prior corresponding period.

Kogan also reported a 120% increase in gross profit and a 140% surge in earnings before interest, tax, depreciation and amortisation (EBITDA) on the prior corresponding period. In addition, the company boasted a strong balance sheet with a cash balance of $78.9 million.

Despite the impressive improvements, investors were quick to sell their Kogan shares.

How did Kogan perform for the first half of FY21?

The Kogan share price took another tumble after the company released its results for the first half of FY21 in late February.

For the first half, Kogan reported a 97% increase in gross sales of $638 million. In addition, the online retailer reported an 88.6% jump in revenue of $414 million. Despite record spending on marketing, Kogan also reported a 165% increase in net profit of $23.6 million.

Kogan noted a 77% year-on-year increase in active customers to 3 million. In addition, the company more than doubled its interim dividend to 16 cents per share.

However, investors were disappointed with growth figures for January. Adjusted EBITDA for January increased 90% for the month. In comparison, Kogan reported a 269% increase in EBITDA in the first 4 months of the financial year. Kogan's management attributed the slower growth to warehouse capacity issues.

What is the outlook for Kogan?

Kogan was one of the major winners during COVID-19 lockdowns as consumers flocked to online retailers.

For the second half, Kogan noted plans to further expand its exclusive brands and develop Kogan Marketplace. The company did not provide earnings guidance for the full year, rather opting to provide regular business updates.