One company that has continued to bloom in the face of the COVID-19 pandemic is cargo logistics software company WiseTech Global Ltd (ASX: WTC). The WiseTech Global share price has risen by almost 80% in the last 12 months as sales have continued to grow.

Last month, WiseTech announced a 16% increase to revenue in the first half of the 2021 financial year, driven by higher user numbers as well as price increases. Pleasingly for investors, the strong result also contributed to a big lift in the interim dividend. Here's what you need to know about the WiseTech dividend.

What is the company's dividend yield?

In its recent half-year results, WiseTech declared an interim dividend of 2.7 cents per share for the six months to 31 December 2020. This was up 59% on the same period in 2019 and gives WiseTech a trailing dividend yield of around 0.15%, fully franked.

OK, so a 0.15% yield probably isn't going to send many hearts aflutter. But WiseTech is still in growth mode and is focused on investing most of its earnings back into the business. This has helped to quickly grow earnings over the last few years, which has resulted in a steady lift in the WiseTech share price, as well as its dividend.

Is the WiseTech dividend growing over time?

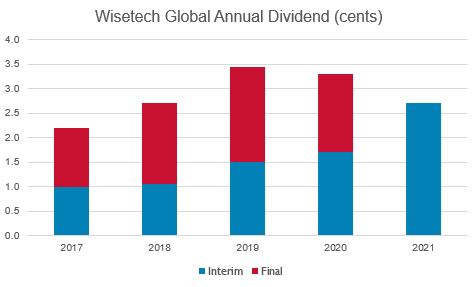

WiseTech only listed on the ASX in 2016, but has been a devout dividend payer since. In the chart below we can see that the company has also been fairly consistent in growing its dividend over time. This is in line with the company's dividend policy which targets a payout ratio of up to 20% of net profit after tax (NPAT).

Source: Chart compiled by author using data from WiseTech Global

A 20% payout ratio leaves the majority of earnings free to be reinvested back into the business. In fact, WiseTech reported spending $159 million on product development in FY20 compared to just $11.1 million on dividends paid to investors.

When does WiseTech pay its dividend?

The WiseTech share price will go ex-dividend on Friday 12 March 2021. The 'ex-date' is when the shares start selling without the value of their next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Friday 9 April 2021.