Qube Holdings Ltd (ASX: QUB) shares are having a whirlwind of a day following the company's release of its FY21 half-year (1H21) results for the period ended 31 December 2020.

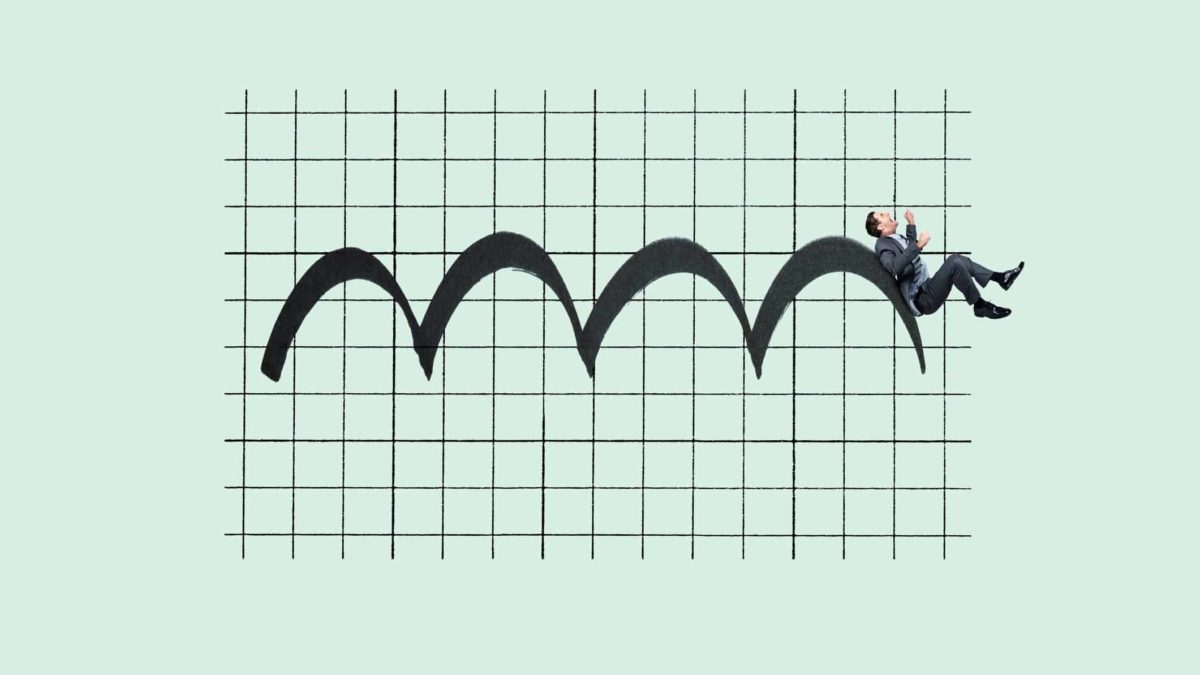

In intraday trading, the Qube share price was down by as much as 4.9%, the biggest intraday percentage drop the company has seen since 11 June 2020. However, at the time of writing, Qube shares have bounced back to trade at $3.12, up 0.97% for the day so far.

Here's what the logistics company reported about its 1H21 performance.

Qube financial highlights

The Qube share price took a dive in morning trade after the company posted statutory revenue of $939.3 million for the period, a 1.9% dip compared to 1H20.

However, underlying net profit after tax attributable to shareholders pre-amortisation (NPATA) increased by 8.5% coming in at $82.8 million.

Earnings before interest, tax, depreciation and amortisation (EBITDA) totalled $204.9 million, which was a smidge higher than 1H20's EBITDA of $204 million.

Basic earnings per share (EPS) inched 3.1% down to 3.1 cents compared to 3.2 cents in 1H20.

The 1H21 fully franked interim dividend per share fell 13.8% to 2.5 cents.

Qube advised that performance continues to be impacted by coronavirus. Incremental costs accrued during the period which exceeded the JobKeeper subsidies received included higher cleaning and IT costs as well as additional labour costs.

Logos transaction and outlook

In other news impacting the Qube share price, the company also reported it has entered into a non-binding commercial term sheet with Logos Property Group. The agreement involves the sale of 100% of Qube's interest in the warehousing and property components of the MLP project (MLP Property Assets) to Logos.

Commenting on this transaction, Qube managing director Maurice James said:

The proposed transaction will allow Qube to realise a strong value for the MLP Property Assets and focus on growing its core logistics business, all while retaining exposure to long-term growth in container volumes at MLP through terminal and logistics activities.

The transaction de-risks delivering the MLP development and warehouse leasing and significantly reduces Qube's ongoing capex requirements. We look forward to forging a strong partnership with Logos at MLP and benefiting from its strong tenant relationships and specialist development expertise.

Qube expects to deliver strong underlying NPAT pre-amortisation (NPATA) results and earnings per share pre-amortisation (EPSA) gains in FY21 compared to FY20.

Qube share price snapshot

Over the past year, the Qube share price has edged around 1.2% lower. However, over the past six months, Qube shares have bounced back, gaining around 9.5%.

Based on the current share price, the company has a market capitalisation of approximately $5.9 billion.