ASX miners have been sitting high on the dividend throne but their reign is under threat as bank stocks are forecast to overtake them in 2022.

While high yielding ASX stocks were forced to slash their dividends in 2020 due to COVID-19, our biggest miners were flushed with cash.

The surprising surge in commodities, like the iron ore price, helped the sector become the dividend king.

Passing of the dividend baton to ASX banks

The Fortescue Metals Group Limited (ASX: FMG) share price, BHP Group Ltd (ASX: BHP) share price and Rio Tinto Limited (ASX: RIO) share price were yielding 7% or more if you included franking.

What's more, they are well placed to increase their dividend payments in 2021 as the commodity price tailwinds continue to blow.

However, the headwinds that have been buffeting the big ASX banks are turning into tailwinds and this sector is rapidly playing catch-up.

Tailwinds driving dividend recovery

The banking regulator has released the banks from a dividend leash as our economy bounces back from COVID.

The property market is also roaring back, which will lower the need for bad-debt provisioning. This assumption is one of the key underpinnings to Credit Suisse's bull case scenario for ASX banks.

"Our bull case for the bank sector is predicated on recovery with the heavy lifting (capital and provision build) having been done in 2020," said the broker.

"This scenario sees dividend growth in 1H21 followed by provision releases beginning in 2H21 as realisation of bad debts come in below modelled economic scenarios.

"At the same time credit growth builds over FY21 on the back of low rates, relaxation of lending standards and government stimulus."

Bull versus bear case

Of course, this bullish forecast will be derailed if the vaccine roll-out hits unexpected hurdles and if our cities reimpose lockdowns.

But Credit Suisse thinks the bull case is a more likely outcome than the bear case. It increased its dividend payout forecast for the sector to 60% from 50% in FY21. The payout goes up to 65% in FY22 and FY23.

Further, the broker highlighting the prospects that the banks will undertake a capital management program as soon as FY22.

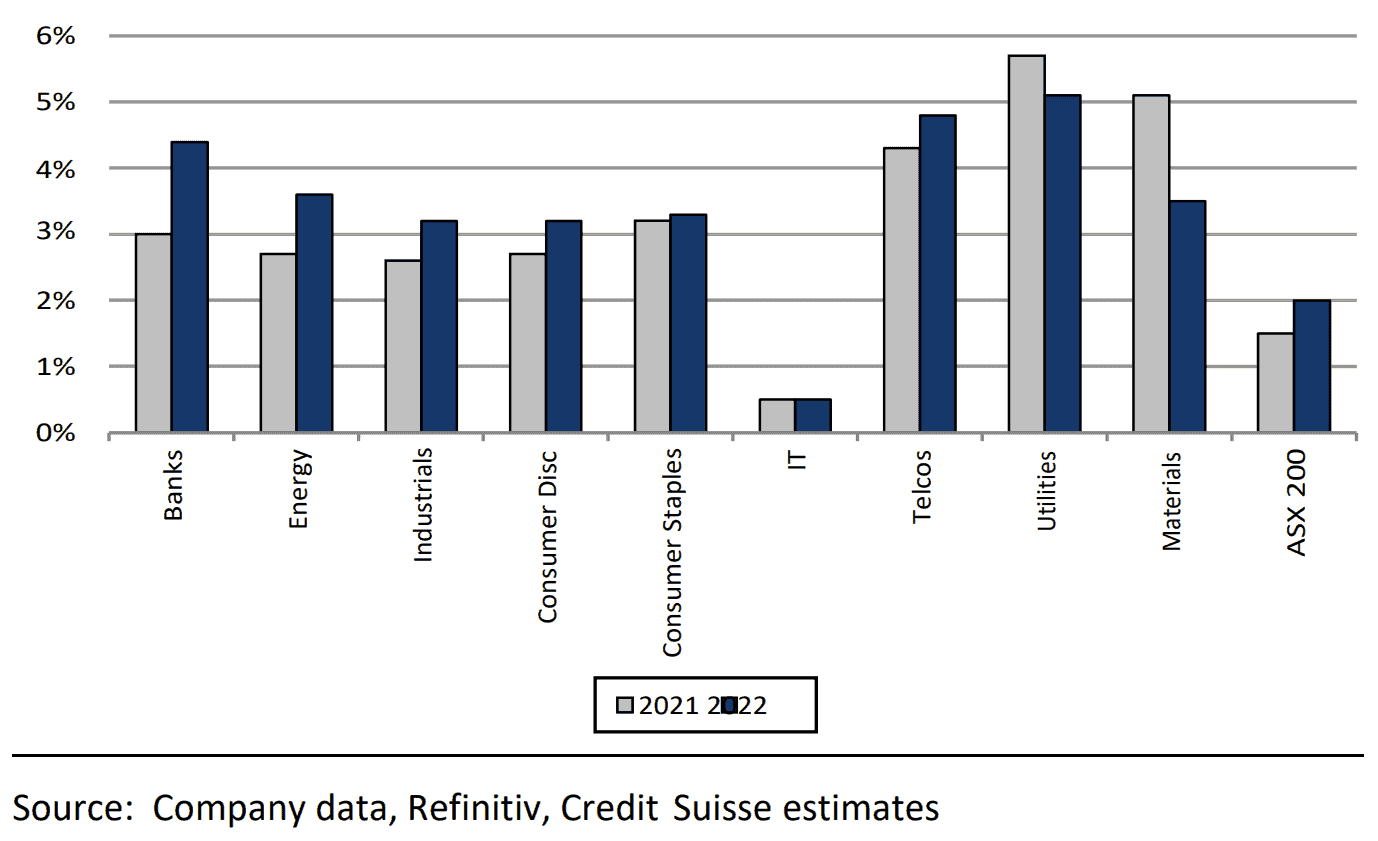

The dividend yield from ASX banks is tipped to increase from 3% in 2021 to circa 4.5% in 2022 (before franking). The yield in the materials sector, which is dominated by miners, is expected to go from a little over 5% to around 3.5% (excluding franking) over the same period.

ASX Banks are the Largest Dividend Recovery Play

Is it time to buy ASX bank stocks?

Credit Suisse has a "buy" recommendation on three of the big four ASX banks. This includes the Australia and New Zealand Banking GrpLtd (ASX: ANZ) share price, National Australia Bank Ltd. (ASX: NAB) share price and Westpac Banking Corp (ASX: WBC) share price.

The Commonwealth Bank of Australia (ASX: CBA) share price is rated "neutral".