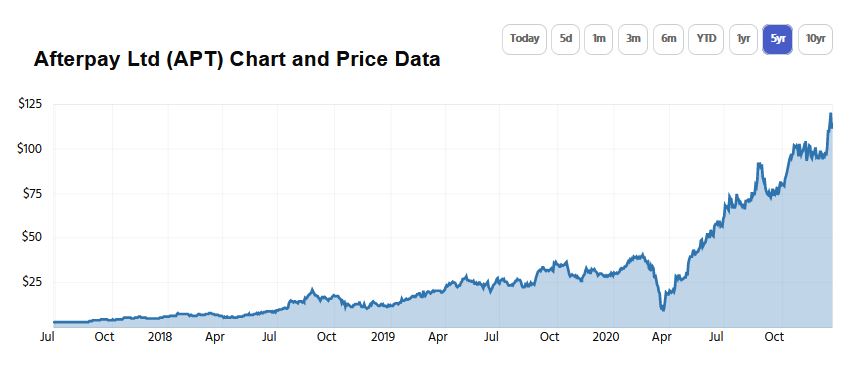

One of the most stunning ASX shares to watch in 2020 has been Afterpay Ltd (ASX: APT). Afterpay shares are today trading at $114.44 at the time of writing, up 2.83% for the day, despite the broader S&P/ASX 200 Index (ASX: XJO) dropping 0.38% today so far.

Afterpay shares blew off some steam last Friday, dropping 7.5% after making yet another record all-time high the previous day. Afterpay's high watermark now stands at an incredible $123.40 a share. Even though the company has cooled off significantly since last week when it made those new highs, Afterpay still commands a market capitalisation of around $32 billion on today's prices.

That places it almost in the middle of Coles Group Ltd (ASX: COL) and Telstra Corporation Ltd (ASX: TLS) in sheer size. That would have been unthinkable at the start of the year. Reflecting this new heft, today actually marks the first day that Afterpay has officially joined both the ASX 50 and ASX 20 Indexes as part of S&P Global's quarterly rebalancing.

So just how rich has this buy now, pay later (BNPL) shooting star made its shareholders in recent months and years? Let's have a look

The never ending afterparty for Afterpay shareholders

So let's get this statistic out of the way first. Afterpay in its current form first debuted on the ASX back in June 2017 after Afterpay and Touchcorp merged to create Afterpay Touch. The earliest recorded Afterpay share price post-merger was $2.95. Any shareholders who bought in back then would be sitting very happily on a gain of 3,844% on today's prices.

But, although a few lucky investors may have executed that particular trade, the reality is that, back then, very few ASX investors would have even been aware of Afterpay shares, let alone the company's concept of its flagship BNPL product.

We'll also get this one out of the way. The Afterpay share price started 2020 at $30.63, meaning the company's shares are up around 270% year to date. That comes after the approximate 100% gain we saw in 2018, as well as a rough 150% gain in 2019.

Afterpay share price rollercoaster

But the Afterpay share price has had a wild year in 2020. Back in March, Afterpay shares fell as low as $8.01, which was the lowest the company had traded at since mid-2018. If any investor was lucky enough to buy Afterpay shares at that particular price on 23 March (a very narrow window of opportunity), the gain they would be looking at on today's prices would be 1,335%. Not a bad return for 9 months. As an indication, if an investor bought 1,000 shares at that price on that day, it would have set them back $8,010. Those 1,000 shares would today we worth $114,440. Enough said.