Fund managers are buying ASX financial stocks at a record clip in October and they are likely to remain keen buyers going into the year end.

These insights are based on JPMorgan's Fund Manager Radar survey with the broker coining the phrase "Fear of Financials Outperforming" (FOFO) to explain the movement.

Financials have been lagging in 2020 as the sector heavyweights, the big banks, have been out of favour with professional investors.

Tide turning for ASX bank stocks

The Westpac Banking Corp (ASX: WBC) share price crashed by 17%, while the National Australia Bank Ltd. (ASX: NAB) share price and Australia and New Zealand Banking GrpLtd (ASX: ANZ) share price lost around 8% each since the start of the year.

Only the Commonwealth Bank of Australia (ASX: CBA) share price is on par with the S&P/ASX 200 Index (Index:^AXJO) with both at breakeven.

Fund managers still underweight on ASX financials

But the tide may be turning. JPMorgan noted that fund managers have increased their weighting to the sector by 67 basis points (bp) in October, the largest one-month increase in the survey's history.

Despite the recent buying, funds are still severely underweight (UW) on financial stocks.

"However, the sector remains at a deep UW of -450bp – still the deepest UW," said the broker.

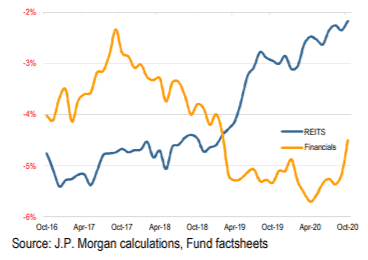

"We see parallels emerging between the narrowing of the REITS UW from Oct-16 to what we are witnessing today in Financials. Through this period REITS outperformed the Banks by 2300bp."

Financials Vs. Real Estate Investment Trusts (REITs) Average Weighting

Most loved ASX big bank stock

Around 60% of funds that JPMorgan tracked have increased their holdings of financial stocks in October. The ASX financial stock that was most sort after was the NAB share price, which became the third most widely held stock by funds in the survey.

The top two are the BHP Group Ltd (ASX: BHP) share price and CSL Limited (ASX: CSL) share price, respectively.

ASX stock rotation underfoot?

However, if fund managers were to keep buying financial shares, they probably will need to sell other stocks to fund the trade.

"Cash was drawn down again in October. Average holdings are now 10bp from the lowest point on our FMR records of 2.9%," added JPMorgan.

"Of the managers we track, 65% reduced holdings, with four funds cutting holdings by over 200bp."

If these investors continue to upweight on financials, it could potentially put outperforming tech stocks at risk, in my view.

Tech darlings like the surging Afterpay Ltd (ASX: APT) share price may make an ideal funding source as they rotate into beaten down financials.