For ASX share investors, turning a small nest egg into more than $1 million seems impossible. When you make that timeline just 30 years, it seems outrageous.

However, it isn't impossible and the numbers really do make sense. With some disciplined investing, modest contributions along the way and the magic of compounding returns, a $1 million ASX share portfolio could be within reach.

How the numbers work

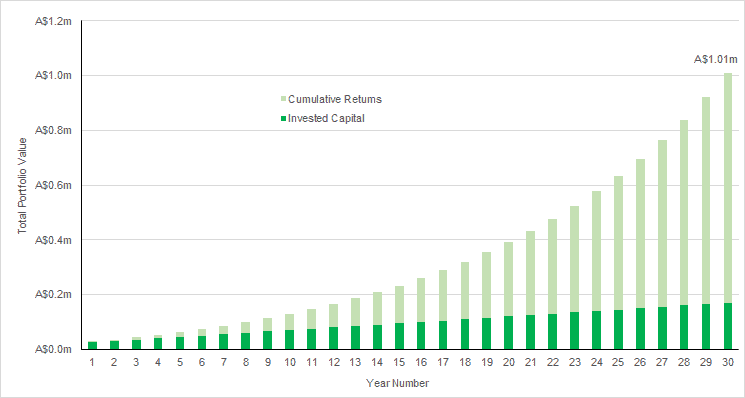

I've whipped up a very quick example to illustrate just how simple the numbers are. This scenario assumes a starting portfolio of $20,000, an annual return of 9.0% and $5,000 in yearly contributions.

This fictional investor would start out with an ASX share portfolio of just $20,000 in year 0 which would climb to $27,250 by the end of year 1. However, the power of compounding returns really kicks in beyond the 20-year mark.

Just by reinvesting these returns and contributing $5,000 per year, our average Aussie investor builds a $1.01 million portfolio within 30 years. That means if they started at the age of 25, they could have built that nest egg by the age of 55.

The best part? That $1 million portfolio only includes $170,000 of invested money with the rest coming from compounding returns.

Setting up an ASX share portfolio

The numbers show that it's possible to turn $20,000 into over $1 million in the space of 30 years. That was clearly a simplified example with an assumed set return always reinvested back into the portfolio.

But even in a simplified example, we can see that the numbers work. The hard part is how to build out a portfolio to generate that target return.

There are many ways to set up such a portfolio. It could be done through buying (and eventually selling) ASX growth shares or choosing high-yield dividend shares.

If we go with the latter, it's easy to see how a 9.0% return is possible. Shares like Scentre Group (ASX: SCG), New Hope Corporation Limited (ASX: NHC) and Westpac Banking Corp (ASX: WBC) all have dividend yields around that mark.

Even the historical averages for major share market indices like the S&P/ASX 200 Index (ASX: XJO) are around 9% per annum.

Foolish takeaway

Portfolio construction is not something that happens overnight. It's worth taking the time to consider long-term investment goals before diving into buying ASX shares.

Shares can be expensive to buy and sell once you factor in taxes and transaction costs. A high-yield ASX share portfolio can help many Aussie set themselves up for retirement with a bit of hard work and a touch of luck.