You might not think it, but the COVID-19 pandemic isn't good news for the Propel Funeral Partners Ltd (ASX: PFP) share price.

While restrictions on gatherings at funerals have weighed in the near-term, the industry is facing a longer-term impact too.

But at least the Propel share price is showing some life this morning after management released a pleasing September quarterly update.

PFP share price coming alive

Shares in Australia's second largest funeral services group jumped 2.5% to $2.84 – taking its year-to-date loss to 16%. This is around 9% below the S&P/ASX 200 Index (Index:^AXJO).

But Propel is in good company. The InvoCare Limited (ASX: IVC) share price lost 22% over the same period.

Earnings jump Propels stock

At least the first quarter of this financial year is kinder to Propel. Management reported a circa 18% rise in operating earnings before interest, tax, depreciation and amortisation (EBITDA) to $10.5 million.

What's more, the average revenue per funeral rebounded to $5,835 from $5,421 in the previous quarter and is 2.9% above the FY20 average.

Management also boasted about strong cash flow conversion (where the EBITDA figure is close to operating cash flow). But investors will have to wait for the 4C to be released to see what the ratio is as the number wasn't provided.

How COVID is impacting the sector

It seems the worst of the social restrictions may be behind the industry too. Most states in Australia and most areas in New Zealand now allow 100 mourners to attend funerals. Victoria is the laggard, but even in COVID central, you can have up to 10 people attend.

These restrictions have limited the opportunities for funeral companies to upsell services. Meanwhile, the relative low number of deaths in both countries have also dragged on funeral stocks even as the virus claimed over one million lives worldwide – and counting.

Jumping from one challenge to another

But the industry isn't out of the woods. COVID is forcing us to adopt new habits, such as social distancing and better hygiene.

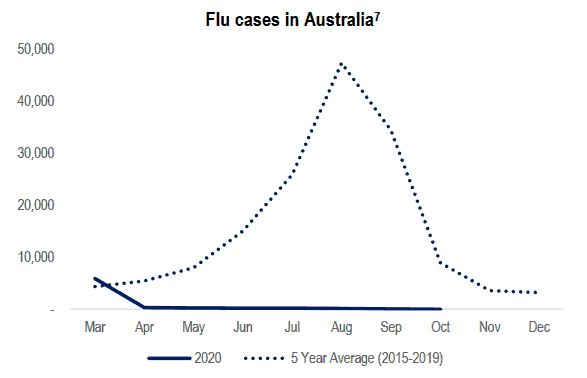

What this means is that very few of us are catching the flu. The rates of influenza are a key earnings driver for the sector given how many people die from its complications.

"Death volumes were materially below historical long term trends in key markets within which Propel operates," said Propel.

"For example, in Tasmania registered deaths declined 12.6% on the [previous corresponding period]; and flu cases in Australia were circa 99% below the prior 5 year average."

Source: Propel Funerals

The funeral industry could be facing its own structural challenge if we continue with our good habits!