This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Electric car manufacturer Tesla Inc (NASDAQ: TSLA) has been growing by leaps and bounds, and with high demand exceeding its production capabilities, the company is at low risk for a slow season. In fact, a recently leaked email from CEO Elon Musk indicates that Tesla is about to beat yet another of its records for vehicles delivered during the quarter.

If that's so, why aren't analysts evaluating the company and its stock rejoicing?

Delivery estimates are high

Tesla's leaked email indicated that the company could record its highest-ever vehicle deliveries during the third quarter of 2020. The last record was set during the fourth quarter of 2019, with 112,000 vehicles delivered.

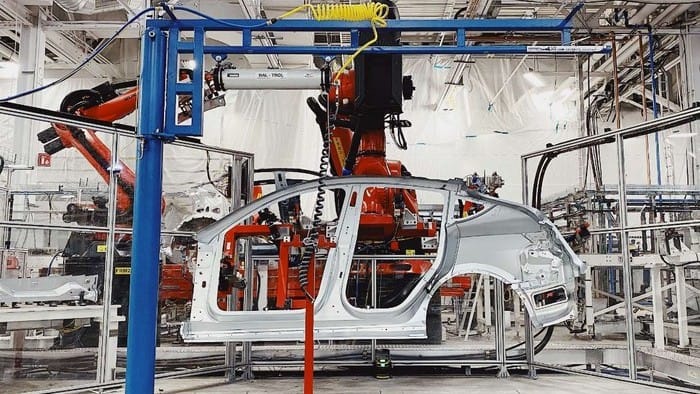

Why all this concern about deliveries? As a full-chain manufacturer that has control over its production from beginning to end, Tesla does not record any revenue on its products until the finished vehicle is delivered to its consumer. So the growing number of deliveries not only serves as a barometer for customer demand, but it also means the revenue recorded could potentially lag the company's investment in parts and factories by a significant amount.

However, given the wording of Musk's email, the expected new record seems to refer to a narrow margin over the past record of 112,000, placing the company's expected number of deliveries between 110,000 and 115,000. The only problem is that a general survey consensus expected 123,000 vehicle deliveries in the third quarter, given the company's previous forecast of 500,000 deliveries for the entire year. That means Tesla expects to beat its previous record, but that the new record will actually be less than the analyst estimates.

So what if it's a miss?

Is it really such a big deal if Tesla comes in below estimates? Indeed, Tesla could be setting a new record despite economic kinks, and that is what investors should really be focusing on.

Like many other companies during early 2020, Tesla had to close some of its factories as the COVID-19 pandemic has spread across the world. On one point earlier this year production came to a full stop, interrupting the company's attempts to ramp up capacity and resulting in a year-over-year 5% drop in second-quarter revenue. Musk acknowledged that Tesla still has wrinkles to iron out before it can crank out more product.

However, the Chinese appetite for Tesla cars increased by 56% during the first six months of 2020 compared to the prior-year period, and this was despite the pandemic-related shutdowns. If the third-quarter vehicle deliveries include US vehicles whose production was delayed during the second quarter, then it seems logical that Tesla, back at full-capacity production by now, should be able to meet or even beat estimates for third-quarter deliveries.

The fact that the company is surpassing last year's record quarterly deliveries is astounding in and of itself. But not meeting expectations means that the company is either still dealing with backlogged production or lagging demand in the new Chinese market. Since China's deliveries are only increasing quarter after quarter, it seems likely that the issue here is too much demand for a still-scaling pipeline.

Given all that, of course, Tesla is definitely in a better place than would be implied by missing delivery expectations. However, in order to justify its current valuation, Tesla would need to not just meet, but exceed, investors' expectations, even during this pandemic. This automotive stock may be taking the long road to changing the car industry, but beating its own record in a time of economic downturn is already amazing enough.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.