This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

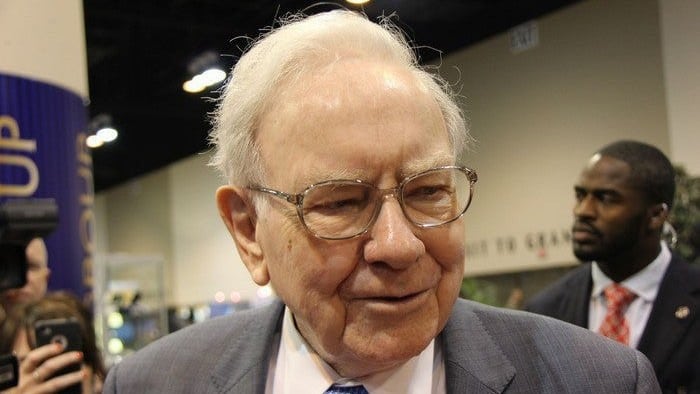

How's Warren Buffett doing these days? Quite well. The legendary investor recently celebrated his 90th birthday, and he appears to be as active as ever.

On the other hand, Buffett's investments haven't performed so well this year. Most of the billionaire's personal fortune is in Berkshire Hathaway Inc. (NYSE: BRK.A) (NYSE: BRK.B) stock, which is down slightly year to date. Quite a few of Berkshire's equity holdings have also declined this year.

Not all of them, though. Buffett and Berkshire definitely have some winners. That's true even if we only include stocks held since the beginning of the year, which would leave the post-IPO skyrocketing Snowflake Inc (NYSE: SNOW) off the list. Here are Buffett's three best-performing stocks so far in 2020 and whether or not they're still good picks to buy now.

1. RH

Berkshire Hathaway doesn't have a huge position in RH (NYSE: RH), formerly known as Restoration Hardware. But it's a quintessential Buffett stock. RH is also the billionaire investor's biggest winner in 2020 thus far. The stock has soared 77%, recently hitting an all-time high.

Home improvement is hot these days. The COVID-19 pandemic has fueled the flames with more people staying at home. RH has been a prime beneficiary of this trend as a leading luxury home furnishings retailer.

You can credit RH's sizzling Q2 performance for its position as the top performer in Berkshire's portfolio. The company generated 54% year-over-year earnings growth, with gross margins rising to 46.9% from 41.7% in the prior-year period. Free cash flow doubled year over year to $218 million.

2. Amazon

Amazon.com, Inc (NASDAQ: AMZN) ranks as Buffett's second-best-performing stock this year, with a gain of 60%. Were it not for the recent big tech stock sell-off, the e-commerce giant would have taken the No. 1 spot.

Still, it isn't surprising that Amazon has been a big winner. The lockdowns caused by the coronavirus pandemic sparked a surge in online shopping. This obviously helped Amazon as the world's leading online retailer. It also worked to the company's advantage in other ways. For example, Amazon's cloud hosting business received a boost as organizations moved their apps and data to the cloud.

Technically, Berkshire's decision to invest in Amazon was made by one of the company's top investment managers rather than Buffett himself. However, Berkshire doesn't put hundreds of millions of dollars in a stock without the Oracle of Omaha giving his blessing. Buffett has acknowledged, though, that he has "been a fan" of Amazon and "an idiot for not buying it" in the past.

3. Apple

What's Warren Buffett's favorite stock (other than Berkshire Hathaway itself)? Apple Inc. (NASDAQ: AAPL). It's Berkshire's largest holding by far. Apple is also one of Buffett's top stocks so far in 2020, with a gain of 46%.

The main reason for Apple's tremendous performance this year is the company's continued booming business. Apple reported record results in Q3. Revenue jumped 11% year over year to $59.7 billion. Earnings per share soared 18%. The company generated operating cash flow of $16.3 billion.

Apple also benefited from investors' excitement over its 4-for-1 stock split announced in July. Sure, this stock split didn't change anything fundamentally about the company or its prospects. Several trading platforms also allow buying partial shares of stocks, making stock splits less meaningful than they've been in the past. However, Apple's stock split came at the right time to create buzz for the stock.

Although Apple has been subject to a September sell-off, the drop may not linger -- especially after certain upcoming developments.

Are they buys?

Yes, yes, and yes. My view is that all three of these Buffett stocks are great picks right now for other investors.

I think that the real estate and home improvement markets will continue to boom. Low interest rates will certainly help. An ongoing trend of families moving to larger suburban homes could also accelerate with increased adoption of working from home even after the COVID-19 pandemic ends. These factors should all be great growth drivers for RH.

As for Amazon, my view is that it won't slow down anytime soon. E-commerce and the cloud will become even bigger. I look for Amazon's expansion into new areas (especially healthcare) to pay off nicely in the future as well.

Apple should profit tremendously from the adoption of high-speed 5G networks. The company will soon launch its first 5G-enabled iPhones. I think this will spur a huge wave of customer upgrades. I'm also optimistic about Apple's opportunities with its services businesses and in new technologies, such as augmented reality. My hunch is that Apple will remain one of Buffett's favorites -- and top performers -- for years to come.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.