Is the Altium Limited (ASX: ALU) share price a strong buy today?

I think Altium is an interesting business that could be worth a closer look because Altium shares have fallen by 11% since 25 August 2020.

A quick overview of Altium

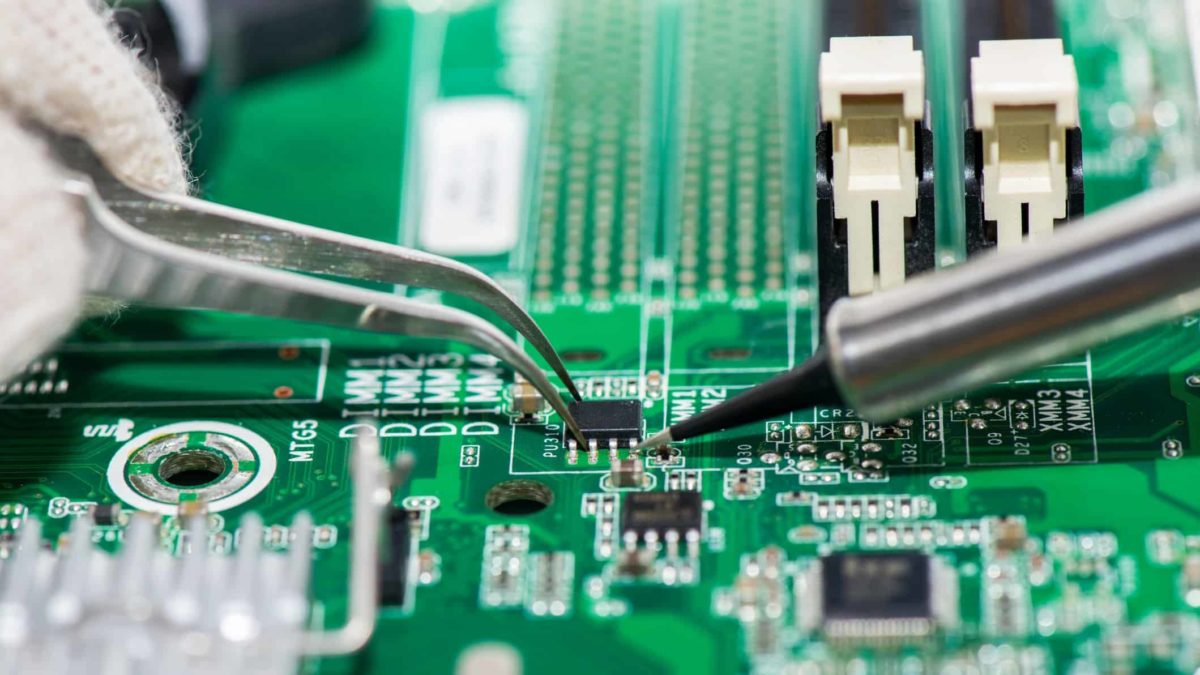

Altium is an electronic PCB software design business. It has several segments. Its core segment is Altium Designer. Other divisions include Nexus, Tasking and Octopart. It's an integral part of the electronics world.

The ASX tech share offers software to individual engineers all the way up to large multinational design teams.

It has an impressive list of high profile clients including: Space X, NASA, Tesla, Boeing, Lockheed Martin, Bosch, Google, Apple, Amazon, Microsoft, Broadcom, Qualcomm, CSIRO, Siemens, Proctor & Gamble, Honeywell, Cochlear Limited (ASX: COH), ResMed Inc (ASX: RMD), John Deere and so on. Many of these are leaders in their industries.

FY20 result

FY20 was certainly a mixed bag for the ASX growth share. Revenue grew by 10% to US$189.1 million, it would have been materially higher if it weren't for COVID-19 impacts.

Altium said that in the fourth quarter it extended payment terms for customers and launched "attractive pricing".

Earnings before interest, tax, depreciation and amortisation (EBITDA) increased by 13% to US$75.6 million with the EBITDA margin improving from 38.9% to 40%.

Profit before income tax went up by 12% to US$64.6 million. Profit after tax fell 42% due to a one-time accounting charge for a deferred tax asset revaluation based on US tax optimisation to decrease the effective tax rate in FY21 to between 22% to 25%, down from the previously stated 27% to 29%. Operating cashflow dropped 18% to US$56.5 million.

Normalised earnings per share (EPS), which excludes that tax change, rose by 5%. The Altium share price isn't likely to grow if the profit growth doesn't impress.

However, there was good news on the balance sheet side of things. The cash balance rose by 16% to US$93 million and the Altium FY20 dividend was increased by 15% to $0.39 per share.

Is the Altium share price a buy?

FY20 didn't go according to plan. It saw the ASX growth share not hitting its long-term goal of US$200 million by 2020. It also caused Altium to suggest that it may take a little longer to hit its US$500 million revenue goal (it was originally targeted for 2025).

However, I think the Altium share price reduction reflects that reality. Interest rates are lower than they were before COVID-19, which supports a higher share price.

Looking at the Altium share price, it's down 22% since 17 February 2020 and it has fallen 11% since 25 August 2020.

Altium gave a roadmap for its expectations about revenue, EBITDA and the EBITDA margin over the next five years. It's expecting strong progress in FY24 and FY25.

I think it's important to remember that Altium has long-term growth aspirations leading up to 2025. But I don't think growth is suddenly going to stop once it gets to US$500 million revenue.

If you use a discounted cashflow model style of investing, I think it's quite easy to argue Altium has a good chance of producing strong shareholder returns over the next decade if it keeps building market share.

When you look at the short-term valuation it does look fairly expensive at 58x FY21's estimated earnings. It's possible that the EBITDA margin could go backwards in FY21.

In the short-term I think there could be more volatility for ASX shares, particularly when it comes to businesses linked with the US due to the upcoming election. The last quarter of 2020 could be a buying opportunity for Altium shares.

If you take a long-term view I think this Altium share price could be a good long-term buy for 2030. However, I don't think I'd want to buy shares in 2020 unless it drops under $30 because of the short-term uncertainties.