The Virtus Health Ltd (ASX: VRT) share price has fallen 4.7% this morning after the IVF provider released its full year results. At the time of writing, the Virtus share price is trading at $3.03 after closing yesterday's trade at $3.18. Virtus felt the impact of COVID-19 on demand for its services, seeing earnings per share fall 98.3%. Nonetheless it says trading activity has rebounded in July, providing confidence for FY21.

What does Virtus Health do?

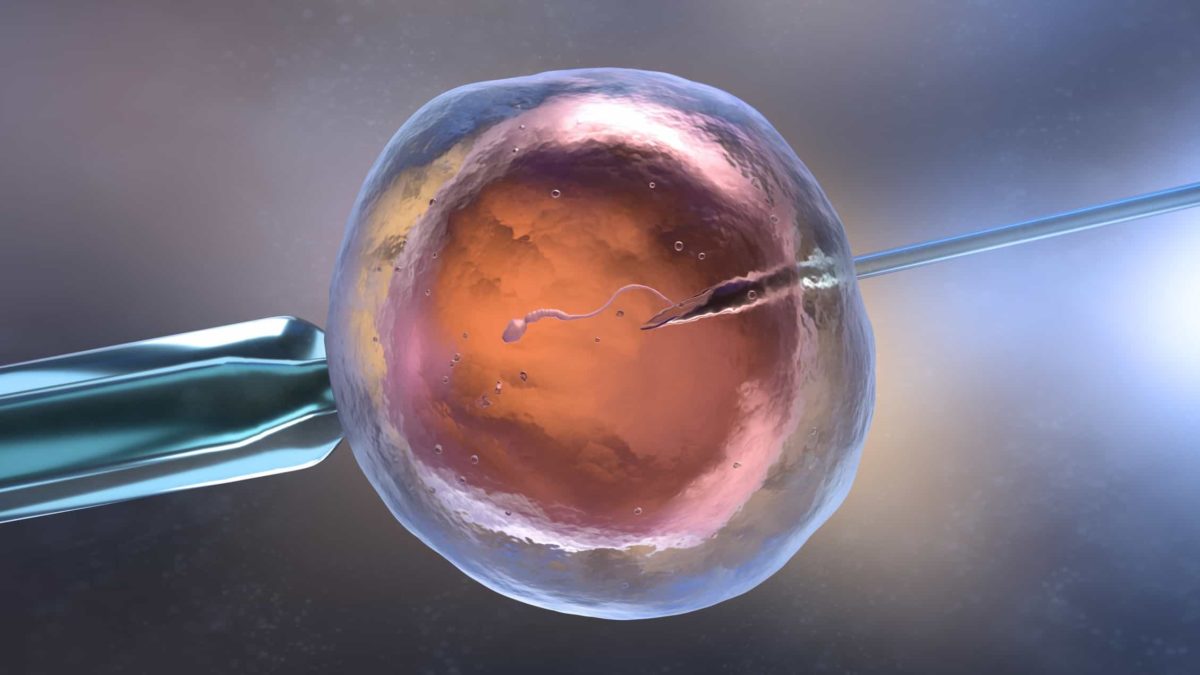

Virtus Health is one of the largest reproductive services providers in the world. Operating in Australia, Ireland, and Denmark, with a growing presence in the United Kingdom and Singapore, Virtus Health provides a comprehensive range of fertility and IVF services. In Australia, the company operates seven day hospitals supporting its core IVF expertise and offers a range of general pathology services as well as specialist fertility and high-end genetic testing.

What did Virtus Health report?

Virtus saw a 7.5% decline in revenue in FY20 which fell to $259 million. Lower IVF volumes resulted in a decrease in diagnostics revenue. Day hospitals were impacted by elective surgery restrictions and saw a decline in non-IVF procedure revenue. International revenues represented 19% of group revenues, with Danish and Irish revenue impacted by COVID-19 shutdowns. Nonetheless, the international business saw strong growth in fresh IVF cycles in June and July following the easing of restrictions in Europe.

Reported group earnings before interest, taxes, depreciation and amortisation (EBITDA) fell 27.2% to $46.2 million, from $63.5 million in FY19. This decline was driven by an estimated gross profit loss of ~$14.6 million from lost revenue due to COVID-19 impacts on activity. Non cash impairment charges of $25 million were recognised which contributed to a 94.4% fall in NPAT attributable to shareholders. Having regard to the uncertainty in the current environment, the board chose not to declare a final dividend. Nonetheless, the deferred interim dividend of 12 cents per share will be paid in November.

What's next for the Virtus share price?

Virtus Health has recently redefined its strategic direction, aiming to be the global leader in precision fertility. The company has been focused on optimising existing operations and developing virtual clinic technologies. This will enhance reach and reduce 'bricks and mortar' investment, driving significant efficiencies. Virtus says it is well positioned to manage any further disruption from COVID-19, with a continued focus on business development and margin improvement. Services have largely recommenced with COVID-19 highlighting the importance of family and IVF recognised as an essential service in the second wave in Victoria. The Virtus share price has risen 94% since its March low but is 35% lower in year-to-date trading.