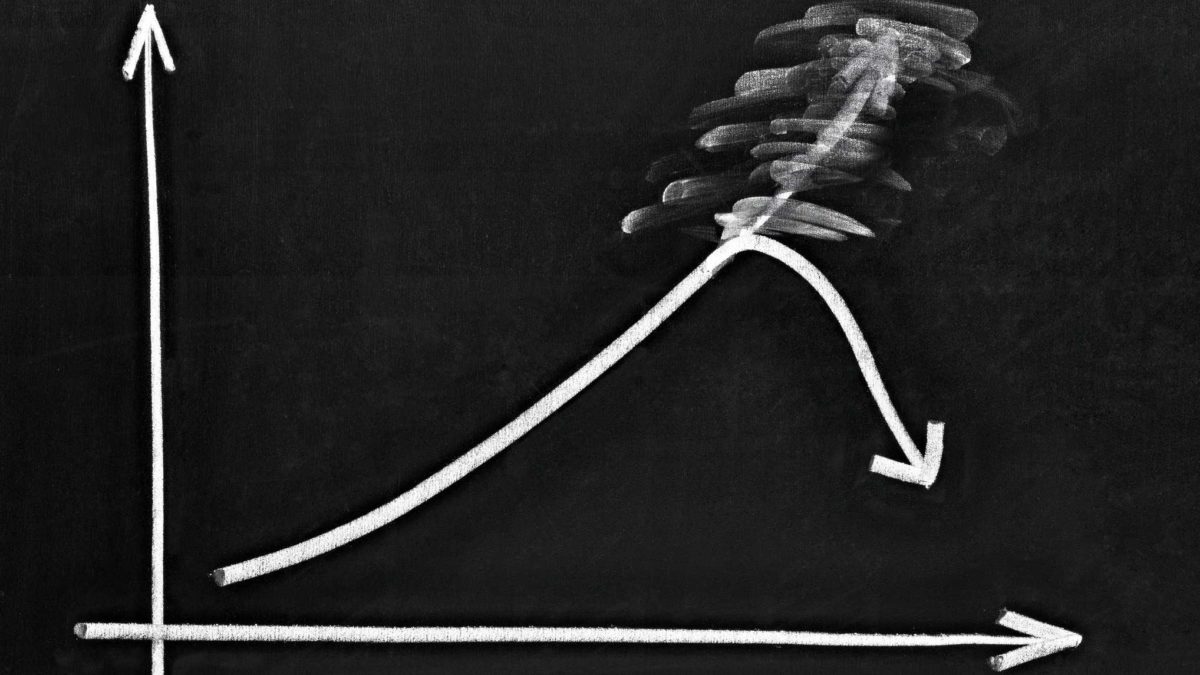

The Phoslock Environmental Technologies Ltd (ASX: PET) share price has fallen by more than 20% today, at the time of writing. The company released a business update after trading on Thursday, which has been badly received in the market. Phoslock sells a range of products for water management. Among them is its patented technology to clear polluted waterways of algal blooms.

What moved the Phoslock share price?

The company's business update disclosed a number of issues likely to continue impacting it in FY21. On the one hand, the company has logistical difficulties executing awarded projects. On the other hand, it has very high receivables due to coronavirus impacts. Combined with the lower sales activity, this has resulted in a negative cash flow position for the period.

Operations

Unusually high rainfall during June and July has resulted in flooding and deterioration in water quality in several regions of China. This delayed projects underway at Shilongba, Xingyun Lake, Wuhan, Jiangsu, Zhejiang and Shanghai. In addition, the second wave of coronavirus in Beijing has caused problems due to travel restrictions. The company does, however, still have many ongoing projects that are continuing unaffected.

In Europe, authorities have suspended several projects to prioritise spending into more urgent public health issues. Projects progressing to plan are in the Netherlands, Belgium, Denmark and Italy.

The company's projects in Brazil are continuing as planned, despite the challenging situation that has arisen from the pandemic. Phoslock expects Brazil to achieve forecast by financial year end. Moreover, all current projects are continuing in North America.

All of these operational issues are continuing to weigh heavily on the Phoslock share price.

Management commentary

Managing Director and CEO, Lachlan McKinnon said "The first half of 2020 has been a challenging period for the business. Events outside the control of the Company have resulted in project delays, lower than anticipated revenues and a working capital and cash flow that is currently weaker than expected.

It is important to stress however, that we have had no project cancellations and all of our announced contracts are expected to be fulfilled in due course."

Company performance

The Company's pipeline remains strong with a current high confidence contract value of $380 million. Phoslock's balance sheet also remains strong, with $35 million in cash, $15 million in receivables and no debt at the end of the period. The company has also recently received an indicative term sheet for short-term working capital debt facilities with HSBC. The Phoslock share price has fallen by 20.37% today, at the time of writing.