It's hard to focus on the long-term when ASX shares are so volatile.

The March bear market threw a real spanner in the works for investors. New investors, in particular, can be the first to head for the exits when their investments are falling.

That means now could be a good time to re-evaluate your investing strategy. Let's say, hypothetically, that you've got an initial sum of $20,000 to invest in the share market and are looking at a long-term investment horizon of 20 years. Here's how I would invest $20,000 for 20 years in ASX shares.

How to invest $20,000 for 20 years in ASX shares

Well, $20,000 is a lot of money, but you really want to be able to grow that number over time by investing it into the share market. But every time you buy and sell ASX shares there are costs associated, like brokerage fees and taxes.

I would lean towards investing your first $20,000 in a diversified exchange-traded fund (ETF), as ETFs can provide instant diversification with very low management fees.

If you just want to passively track the Aussie share market, a low-cost ETF like Vanguard Australian Shares Index ETF (ASX: VAS) is a good option.

Vanguard Australian Shares Index ETF seeks to track the S&P/ASX 300 Index (ASX: XKO) and currently holds 306 securities. That's a good chunk of the total share market if you want a passive investment in ASX shares.

It's not just broad market indexes that you can invest in. If you want targeted exposure, you could try a sector or industry-specific index like ETFS Morningstar Global Technology ETF (ASX: TECH).

This allows you to get broad exposure to ASX (and international) tech shares without betting on individual companies straight away.

Buying shares in these sorts of ASX ETFs can provide diversified exposure to a whole host of underlying companies.

But how does it work in practice?

Let's use the Vanguard Australian Shares Index ETF as an example.

Since its inception, this fund has returned an average of 8.18% on an annualised basis.

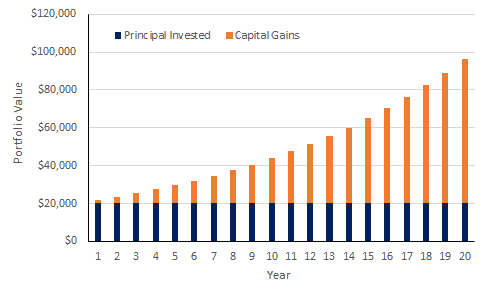

Let's see what happens if we invest $20,000 at 8.18% per year for 20 years:

As the graph above indicates, that initial capital would grow to be worth a handy $96,376 by the end of a 20-year period.

The story is even better if you make some additional contributions along the way. So, if you invested an additional $1,000 per year, that original $20,000 investment would grow to be worth $143,060 across a 20-year investing horizon.

Of course, this is before you take into account inflation and what $96,376 or $143,060 would buy you in 20 years. However, the proof is in the pudding that investing in ASX shares for the long-term can pay dividends.

Can I only achieve this with ETFs?

Not at all! In fact, many investors would have already seen some strong gains this year. In particular, those who purchased ASX shares in mid-March would have picked some absolute winners.

Aside from Afterpay Ltd (ASX: APT), other top performers include A2 Milk Company Ltd (ASX: A2M) and Fortescue Metals Group Limited (ASX: FMG).

Picking high-quality companies and investing with a long-term view is the key. With a strong investment strategy and a touch of good fortune, you may well have more than $96,376 or $143,060 in 20 years' time.