S&P/ASX 200 Index (ASX: XJO) tech stocks have been volatile in 2020, but it has been a mixed bag of performances. Not every ASX 200 tech share has performed as well as Afterpay Ltd (ASX: APT) this year, which means there are many still in the buy zone.

Here are a couple of my top picks that are trading at a good price today.

2 ASX 200 tech shares I'd like to buy today

I think Xero Limited (ASX: XRO) shares are worth a look right now. The Xero share price has rocketed 343.86% higher in the last 5 years but has edged just 6.25% higher in 2020.

Xero provides accounting software platform to small and medium-sized businesses and could see steady earnings despite the coronavirus pandemic.

While some customers may not renew their subscriptions, I think the complexity arising from the JobKeeper stimulus package could be where Xero comes into its own. That's good for earnings and the Xero share price.

I also like the look of Altium Limited (ASX: ALU) shares right now.

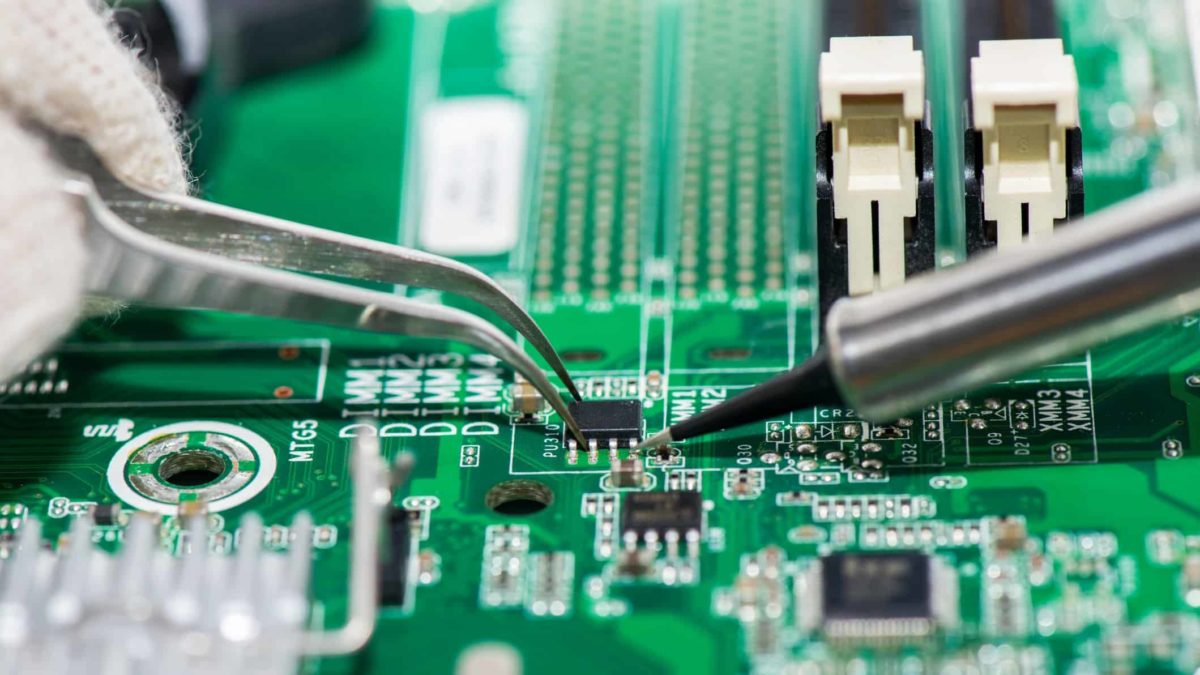

Altium provides electronics design software for engineers who design printed circuit boards. As the global economy emerges from hibernation, I think business could pick up again for this Aussie tech group.

Altium shares are up 19.77% this year, which means its already a strong performer. However, it is currently trading at $37.02 per share (at the time of writing), compared to an all-time high of $42.76.

I think Altium could be an ASX top 50 or even top 20 share within the next decade. With a $4.85 billion market capitalisation right now, Altium is well-placed to capitalise on the changing tech scene here in Australia.

Foolish takeaway

Both Altium and Xero are successful ASX 200 tech shares that have rocketed higher in recent years.

However, I think a recovering economy and strong client base could be the key to boost both share prices even higher in 2020.