Canaccord Genuity initiated a buy rating for ASX 200 rare earths miner, Lynas Corporation Ltd (ASX: LYC). It has a target price of $3.80 and its current share price at the time of writing is $2.01.

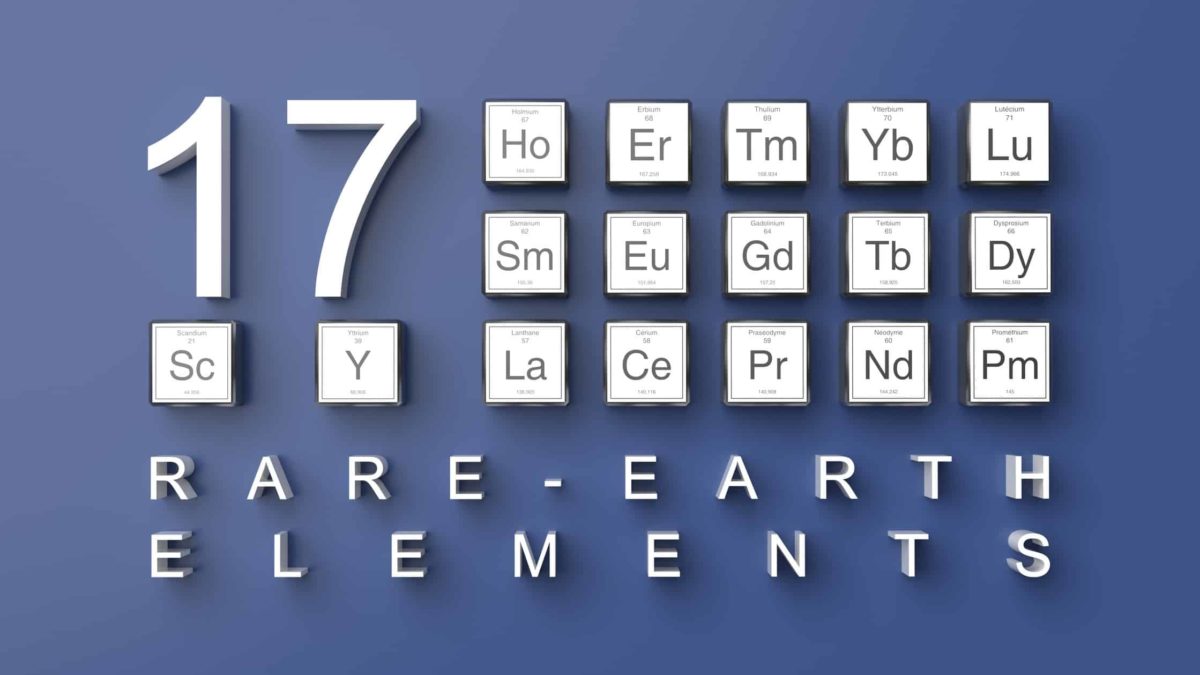

The Aussie miner is a fully integrated producer of refined rare earths. These are a group of 17 chemical elements used in computers, batteries, cellular devices, magnets and defence/military applications. Lynas is the world's largest producer of rare earth elements outside of China. It is also the second largest in the world. Its main operating assets are located in Western Australia and it also has a processing plant in Malaysia.

Magnets – a focal point in rare earths market

Among the key products produced by Lynas are neodymium/praseodymium oxides (NdPr), a critical component in rare earth permanent magnets. These magnets are used in a wide variety of consumer electronics and industrial/high technology applications. This includes in electric vehicles and wind turbine generators. Canaccord forecasts that these emerging renewable technologies will drive significant demand growth for rare earth permanent magnets over the medium to long term.

Supply gap could emerge by 2023

Canaccord anticipates flat demand growth for NdPr in the near term but a post-COVID-19 world could see a recovery in many rare earth consuming industries. This could see a shortage of rare earths by 2023, placing upward pressure on NdPr prices.

China produces approximately 80% of the world's rare earths. However, there has been a recent clampdown on illegal production as well as a move away from producers with poor environmental credentials. Because China has a near 'monopoly' on rare earth production, global consumers are increasingly looking to diversify critical mineral supply chains.

Amidst the heat of the US–China trade war, China threatened to stop delivering supplies of rare earth metals – a key material for US defence and healthcare. The US has since looked at Australia as a key supply partner and a means to move away from its dependency on China. This has resulted in Lynas, in partnership with American company, Blue Line Corporation, being awarded a Phase I contract by the US Department of Defence (DoD). The venture involves planning and design for a US heavy rare earth separation facility intended to fill a key gap in the country's supply chain. Whilst Phase I encompasses design only, its successful completion may lead to further contracts for production and operation for this ASX 200 miner.

Furthermore, in the past, China was able to flood the market and cripple global rare earth prices. This has forced Lynas to develop itself into a consistent, low-cost producer. Today, its low cost capabilities and considerable intellectual property see it well positioned it to expand its production capacity by 2025. This includes relocating its mid-stream processing to Western Australia and upgrading its product separation facility in Malaysia.

Foolish takeaway

Lynas may be vulnerable to the volatile movements of the general market. However, it plays a crucial role in the global supply of rare earth minerals. While it may be a rocky road for the share price in the near term, I believe it is good value for ASX 200 share investors with a long-term mindset.