At the heart of some of the best companies in the world lies a 'flywheel effect'.

A flywheel is a combination of processes that work together to rapidly grow a business over time. The idea was developed by Jim Collins which he described in his book 'Good To Great'.

Recently, I suggested that the flywheel developed by Xero Limited (ASX: XRO) could make it one of the best companies in the world. By using accountants as agents to grow users, Xero is able to produce strong cash flows that can be continually reinvested. I wrote:

"if Xero can maintain disciplined leadership and continue to strengthen and expand its flywheel to stay ahead of the competition, it probably could be considered one of the world's best companies."

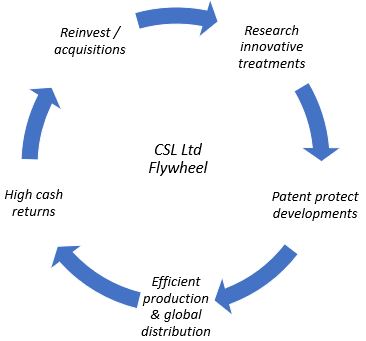

Global biotechnology company CSL Limited (ASX: CSL) is another company I think exemplifies the flywheel effect. CSL has been an absolute compounding star over the last decade and continues to grow revenues at a fair clip. This hasn't been the result of luck or a single defining product, but a set of factors which build on one another continuously.

Here's what I think the CSL Limited flywheel looks like:

Let's look at how the wheel turns.

Researching innovative treatments

CSL focuses on researching innovative products for unmet medical needs. Although this can be a risky area to invest in, success can result in products for new markets without competition. In the 12 months to 30 June 2019, CSL invested a massive US$832 million into research and development (R&D) across its businesses, around 10% of total operating revenue.

Patent protection, efficient production and global distribution

CSL rigorously protects the new treatments it develops with patents. If you're going to invest hundreds of millions of dollars into R&D, you don't want to see your hard work copied or stolen away. CSL can then use its formidable global scale to produce and distribute treatments highly effectively.

High cash returns drive reinvestment, powering the next turn of the flywheel

Patent protection and production efficiency mean CSL can sell at high margins and plough cash back into the business. In the 2018/2019 financial year, CSL had a gross product margin of 56%, returning plenty of cash to reinvest.

Reinvestment is essential to the success of the flywheel. A big chunk of CSL's cash gets fed back into R&D. But CSL also has a history of acquiring businesses which expand its product offering. These include Aventis Behring, which is now known as CSL Behring; U.S. plasma collector Nabi, which helped to form CSL Plasma; and of course, the Novartis influenza vaccine business. Novartis is now known as Seqirus, the world's second-largest influenza vaccines company.

So, is CSL one of the best companies in the world?

CSL could very well be one of the best companies in the world. As the flywheel turns year-in, year-out, CSL compounds growth and delivers increasing shareholder returns. It also gives CSL the capacity to endure tough times and dominate in its market.

Being among the world's best might help to explain why CSL can command such an incredible market valuation. CSL shares currently trade at a trailing 12-month price-to-earnings ratio of 50x earnings. To me, this feels like a high price to pay for a $142 billion company growing revenue at around 11% per year. But perhaps that's the premium afforded to greatness.