The Australian Taxation Office (ATO) says that 360,000 Australians are looking to make a super withdrawal right now. Part of the Australian Government's coronavirus stimulus allows eligible Aussies to withdraw up to $20,000 from their retirement accounts.

But before you join the hundreds of thousands of Aussies making super withdrawals, here are a few things to consider.

Why making a $10,000 super withdrawal isn't a great idea

First things first, this $10,000 super withdrawal is only for Aussies experiencing financial hardship. The ATO has been clear that while 360,000 applications have been made, they may not all qualify.

But when it comes to reasons why you should think twice about making this withdrawal, I need to highlight the magic of compound returns.

As an example, let's consider a 20-year-old hospitality worker who is eligible to tap their retirement account for $10,000.

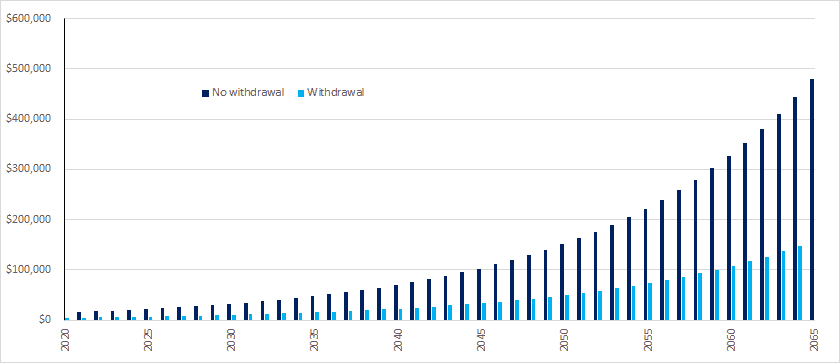

Many of these workers may not have much super to begin with. Let's say they've saved hard and currently have $15,000 in their super account. If their investments returned 8% per year for 45 years, that $15,000 nest egg would grow to $478,807 at the age of 65.

In contrast, by making a $10,000 super withdrawal today, that $5,000 nest egg would become $159,602 at age 65. That means the difference at retirement from a $10,000 withdrawal today could be $319,204.

These are big numbers and the problem with making the $10,000 super withdrawal is two-fold.

For one, using the example above, the hospitality worker's starting base is now $5,000 instead of $15,000. Compounding 8% returns means the $10,000 gap will grow and grow each year – meaning it's very difficult to make up that difference, at any age.

The second issue is that time is now not on their side. Consider that same hospitality worker at the age of 40. That's in 20 years' time, which should be plenty of time to make up that $10,000 difference right? Wrong.

Within those 20 years, assuming 8% and no additional contributions, the hospitality worker's balance would be worth $23,305. Not a bad number, but that's just a third of the $69,914 it would be if the balance was left untouched.

Chart by author

The chart above demonstrates why compounds are so powerful – those 8% returns keep building and building until retirement.

So, before you jump in with the other 360,000 Aussies and make a $10,000 super withdrawal, keep those numbers in mind.

Foolish takeaway

Obviously, if the money is necessary then you aren't left with too many options. However, I'd rather sell down my ASX shares and exhaust all other options before making a $10,000 super withdrawal.