I listen to a lot of podcasts. All sorts of podcasts, but especially investing podcasts. In one show recently, a fund manager suggested that accounting platform company Xero Limited (ASX: XRO) could be one of the world's best companies.

The guest didn't elaborate and the point slipped by uncontested. But could it be true? How could we tell if Xero was one of the world's best companies?

One way would be to look at some obvious traits of great companies. Things like:

- A formidable brand

- Rapid revenue growth

- A robust competitive advantage

- Above-average returns on invested capital

Xero would certainly look good against most of those criteria. A more robust approach, however, would be to see how Xero fits against a framework with a history of defining great companies.

Identifying great companies

Jim Collins is the master defining great companies. He has studied what makes the best businesses tick and wrote the books 'Built to Last' and 'Good to Great'. Collins has identified several factors that are characteristic of great companies, but arguably the most important is the Flywheel.

The flywheel is a self-reinforcing cycle which can create incredible growth momentum. Each turn of the wheel builds upon previous good decisions. Collins uses Amazon as an example of a highly successful flywheel. Amazon uses low prices to attract more customers, which attracts more sellers to the site, which increases sales and allows, in turn, even lower prices. The flywheel builds greatness.

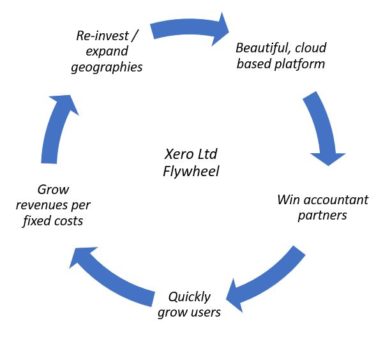

We could map Xero's flywheel to look something like this:

Xero's flywheel starts with a well designed, cloud-based platform. But it is the company's partnership program with accountants that adds the real torque. I don't use Xero because it looks pretty. I use Xero because my accountant tells me to. Having accountants champion the product quickly drives subscriber growth. Because additional users come with very little additional costs, Xero can focus on reinvesting aggressively back into the product.

This reinvestment is crucial. The business can protect its competitive advantage, expand into new geographies and invest in what Collins calls 'Technology Accelerators' to speed up the flywheel's momentum. Xero is doing just that with a focus on automation and machine learning.

So, is Xero one of the world's best companies?

I think Xero has developed a powerful flywheel and knows how to keep it turning. Although Collins acknowledges that the flywheel effect alone does not make an organisation great, it forms the centre of the framework around which the company builds.

This means that if Xero can maintain disciplined leadership and continue to strengthen and expand its flywheel to stay ahead of the competition, it probably could be considered one of the world's best companies.