There are some people in society that believe investing in ASX shares is gambling. Perhaps this is caused by a bad investing experience or ignorance.

Here are 5 key reasons why I believe investing in ASX shares isn't gambling:

- When you buy a stock, you become an owner of the company

- Generally, each share is a voting right you can use at an AGM

- Unlike betting on a horse race, ASX shares can recover losses

- Over the long term, the share price reflects how the business is travelling

- ASX shares pay dividends

Reason 1: When you buy a stock, you become an owner of a company

When you think about stock ownership as becoming an owner of a company, your investment decisions will be based on how the business is performing, rather than how the share price is performing. Remember that risk can be reduced by holding a profitable company over the long run, rather than the short run. That's not to say a set-and-forget approach is bullet-proof, but as Warren Buffett once said, "If you aren't thinking about owning a stock for 10 years, don't even think about owning it for 10 minutes." It's this long-term focus that has created significant wealth for him.

Reason 2: Each share is a voting right you can use at an AGM

As an owner of the business, you can use your voting rights to make a difference to the company; e.g., appoint and cease directorships. As directors help set the strategy for the company, it's vital they have the experience needed to increase the likelihood of success.

Reason 3: Unlike betting on a horse race, ASX shares can recover losses

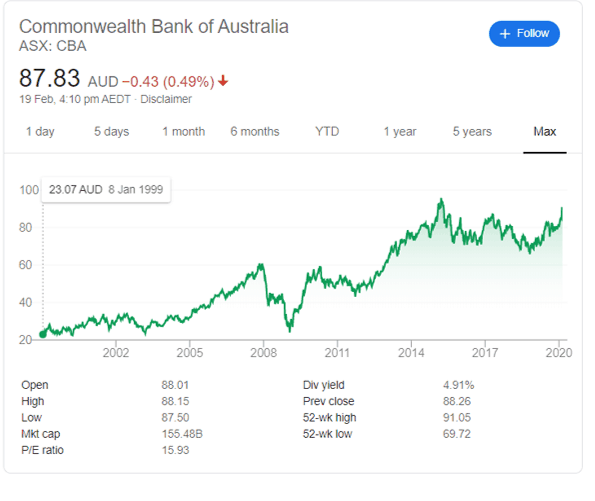

When you put money on a horse race and the horse loses, you have lost the cash. Unfortunately, market corrections impact on ASX shares but history shows that a recovery does happen. For example, an investment in Commonwealth Bank of Australia (ASX: CBA) in the GFC when CBA shares were sub-$30 has rewarded long-term investors significantly – as shown in the chart below.

Reason 4: Over the long term, the share price reflects how the business is travelling

Share prices can be volatile in the short term, but over the long-term, share prices are impacted by the underlying performance of the company, as highlighted by the Commonwealth Bank share price graph above.

Reason 5: ASX shares pay dividends

ASX shares have the ability to reward shareholders in all economic climates. Betting and losing on a horse race won't pay you semi-annual dividends. CBA has consistently paid a dividend since it floated. The amount of dividend it pays today is significantly higher than in 1992. When it comes to benefiting from dividends from growing and profitable companies, it requires time.

Foolish takeaway

Your chances of earning riches off penny stocks is slim. Investing in profitable and growing companies in the ASX 200 such as Wesfarmers Ltd (ASX: WES) is more likely to make a return on your investment. That's why I'm of the view that, by focusing on high quality companies, investing in ASX shares isn't gambling.