If the name didn't give it away, Pilbara Minerals Limited (ASX: PLS) owns and operates mines within the Pilbara region in Western Australia. This region is home to some of the best iron ore and mineral deposits throughout the world.

Some of the ASX's heavyweights operate within this region alongside Pilbara Minerals, including BHP Group Ltd (ASX: BHP), Fortescue Metals Group Limited (ASX: FMG) and Rio Tinto Limited (ASX: RIO). Pilbara Minerals differs to these other companies in that it only produces lithium.

Lithium is a white metal that is extremely useful in many applications – to my surprise it's included in things other than just batteries for Elon's Teslas. It's also included in glass, air conditioning systems, grease and synthetic rubber products. Who knew?

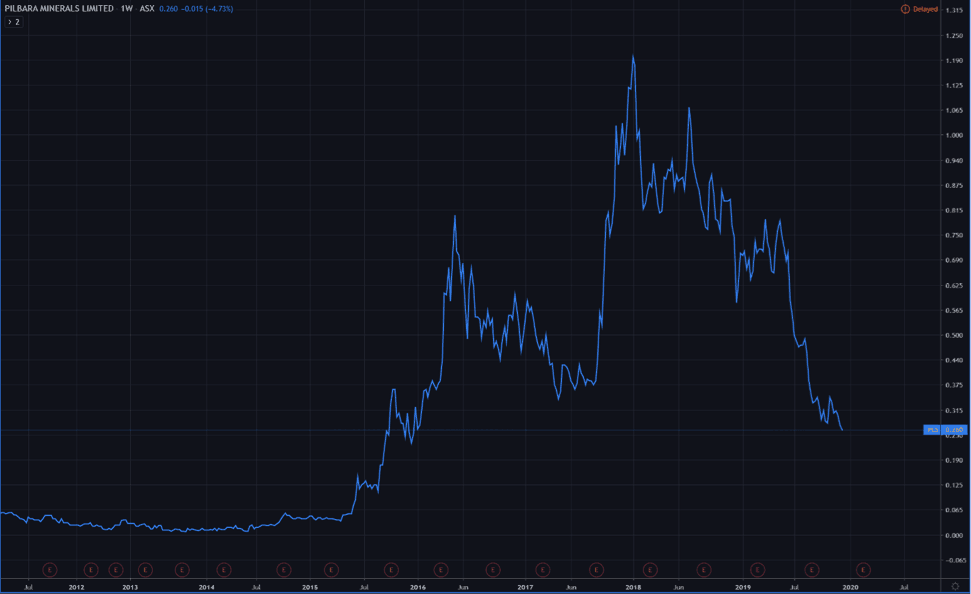

The Pilbara Minerals share price, however, has had a bit of a hard time this year. In fact, let's look at the chart below.

Source: Tradingview.com

This year alone the Pilbara Minerals share price is down a whopping 64%. But why?

Lithium spot price dramas

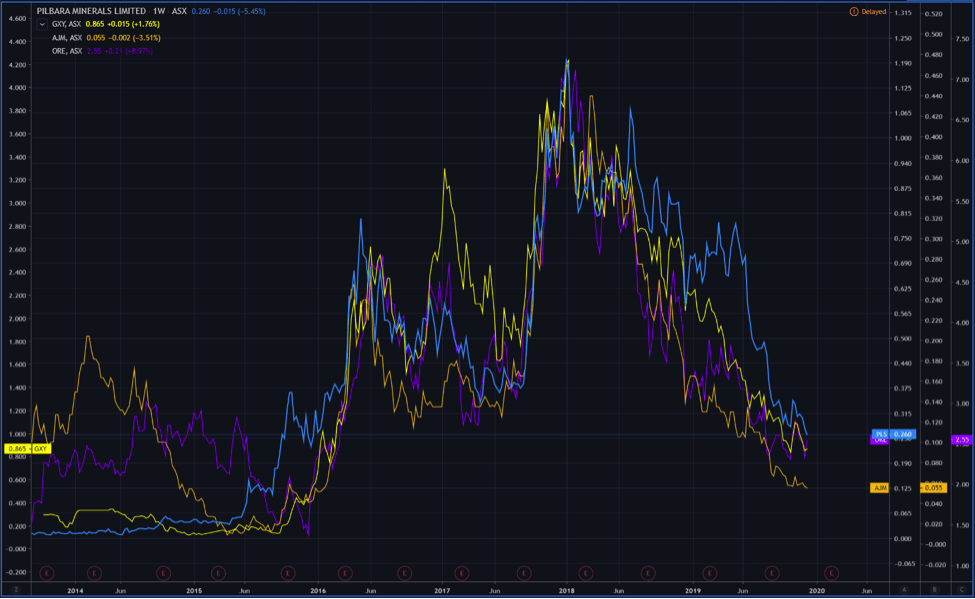

Basic high school economics tells us that when supply increases, but demand remains constant, then the price must shift down. This is exactly what Pilbara Minerals is suffering from this year. In fact, this saga is apparent throughout all lithium producers. Below is a chart showing some other listed lithium producers alongside Pilbara Minerals, including Galaxy Resources Limited (ASX: GXY), Altura Mining Ltd (ASX: AJM) and Orocobre Limited (ASX: ORE).

Source: Tradingview.com

See the trend?

It all started back in 2018 when lithium analysts deemed the metal over supplied. This turned investors into bears and the great sell off started throughout the lithium sector.

Spokespersons from the International Mining and Resource Conference at the time were arguing that the lithium supply chain was much more complex than the market believed. The main issue is the lag from mining to shipping of about 12 months, which creates a lot of forecasting error and speculation within the lithium market.

Will Lithium demand pick up? Aum ?… yes. A big yes.

The most known use case for lithium is batteries and I believe the oversupply concerns are going to come to a screaming halt within the next 5 years – the reason being electric vehicle (EV) demand. The single largest and most expensive component of any EV is the battery – with no petroleum fuel the power has to come from somewhere.

The Benchmark Mineral Intelligence blog states that there are 99 Mega battery factories in the pipeline between now and 2028 – that's not even a decade away. Within the next 3 years, total global output of battery factories in gigawatt hours (like barrels of oil) will increase 3-fold and within 10 years 10-fold. Name another industry that has 10-fold future demand potential within 10 years. You be hard pushed to find one.

Foolish takeaway

The macro drivers for lithium demand are well documented – electric vehicles are the major growth factor looking forward in lithium sector. More battery and electric vehicle producers are coming online and consumer sentiment is shifting from conventional petrol vehicles to electric vehicles or hybrids. This creates a growth opportunity for raw metal providers such as Pilbara Minerals.

As for when the Pilbara Minerals share price slaughter is over, this I can't answer. However, being eternally optimistic, one can't help but see the growth potential of the company. Down 60% in a year, yes. But looking ahead, I see bags (100% profit = 1 bag). Pilbara Minerals has all the existing infrastructure and supply chain established; the hard work is over. All it has to do is weather the storm. Once it's over and the sky is blue, I think Pilbara Minerals shareholders should do well.