The Woolworths Group Ltd (ASX: WOW) share price will be on watch today following the release of its first quarter update.

How did Woolworths perform in the first quarter?

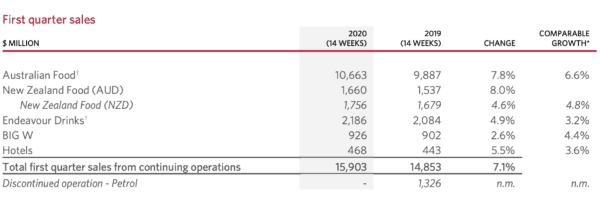

For the 14 weeks to October 6, Woolworths recorded total group sales from continuing operations of $15,903 million. This was a 7.1% increase on the prior corresponding period.

The company's key Australian Food business was a solid performer during the quarter. It posted sales of $10,663 million, up 7.8% on the same period last year. On a comparable basis, Australian Food sales rose 6.6%.

A key driver of this strong quarter was the Lion King Ooshies promotion, which thumped the Little Shop 2 promotion by rival Coles Group Ltd (ASX: COL).

Also contributing was the Discovery Garden promotion and strong online sales growth. Online sales grew 43.2% on the prior corresponding period.

Woolworths also reported growth across the rest of the business. A summary can be seen on the chart below:

What's next?

Woolworths CEO, Brad Banducci, was very pleased with the strong start to FY 2020, but warned that its sales growth would moderate as the financial year goes on.

He said: "It has been a pleasing start to F20 with strong sales momentum across the Group. In Australian Food, sales growth was driven by the success of Lion King Ooshies, Discovery Garden and the continued growth in Online. Customer scores have softened slightly given higher than expected sales growth and the implementation of a new store customer operating model. We expect sales growth to moderate over the remainder of the financial year."

"We are pleased with trading in the year to date and preparations for the Christmas period are well progressed. We remain focused on providing the best possible customer experience across all of our businesses as we manage a material change agenda in the first half including the implementation of our new Customer Operating Model in Woolworths Supermarkets, the rollout of Fresh Made Easy and the ramp-up of the MSRDC. The Endeavour Group transaction is progressing well with the next key milestone a shareholder vote on the Restructure Scheme on 16 December," he added.

Staff underpayment.

Taking the shine off today's strong sales update was news that Woolworths has underpaid staff by upwards of $300 million.

This follows a recent review which highlighted an inconsistency in pay for a number of salaried store team members compared to team members paid under the new Enterprise Agreement (EA).

The company advised: "Woolworths Group unreservedly apologises after a review found that approximately 5,700 salaried store team members working in Woolworths Supermarkets and Metro stores have not been paid in full compliance with Woolworths Group's obligations under the General Retail Industry Award."

The remediation is expected to be in the range of $200-300 million before tax. An update will be provided at its half year results in February.