I don't actually think there is a more loved ASX stock than CSL Ltd (ASX: CSL).

There are many, many reasons to hate the big ASX banks like Commonwealth Bank of Australia (ASX: CBA) or Westpac Banking Group (ASX: WBC) – even though we all love collecting the dividends.

You might not like the coal that BHP Group Ltd (ASX: BHP) digs out of the ground and sells to China.

And you still might not have forgiven Telstra Corporation Ltd (ASX: TLS) for slashing its formerly reliable dividend just a couple of years ago.

But CSL can seemingly do no wrong. The CSL share price has been on an almost-constant upward trajectory over the past decade – I don't think anyone who has bought in since 2009 has lost money after a few months.

And that was back when CSL was a fringe 'hot healthcare growth stock' and going for $30 a share.

Today, CSL is an established ASX blue-chip company and with a market capitalisation of $112.82 billion, is the third-largest stock in Australia. That's right, bigger than Woolworths Group Ltd (ASX: WOW), National Australia Bank Ltd (ASX: NAB) and even Westpac.

At the time of writing, the CSL share price will set you back an eye-watering $248.39 per share – which happens to be very close to the all-time high CSL set just yesterday of $248.88. Compare this to the start of 2019 when CSL share were at $185 and you can see that investors think this company still has plenty of petrol left in the tank.

But does it? That's what we'll be looking at here.

Who is CSL?

Source: CSL Ltd Fy19 Annual Report

CSL is often just labelled a 'healthcare company' but it's a bit more nuanced than that. CSL has an interesting origin story as a government-owned company (CSL stands for Commonwealth Serum Laboratories).

It started life in 1918 as a government department responsible for manufacturing vaccines and later expanded into anti-venoms for snake bites. Its other achievements since its founding include a major role in the eradication of polio in Australia with its vaccine during the post-war era as well as pioneering research into HIV transmission in the 1980s.

In 1994, CSL was privatised and listed on the ASX for $2.30 per share (yes, you read that right). Since that time, it has continued to expand in the medical scene as well as making waves overseas.

In 2009, the Australian government ordered 21 million vaccines from CSL to combat the Swine Flu epidemic – showing what kind of position this company now has in our national conscience.

How does CSL make its money?

CSL has two divisions (both with very funky names) – Seqirus and CSL Behring.

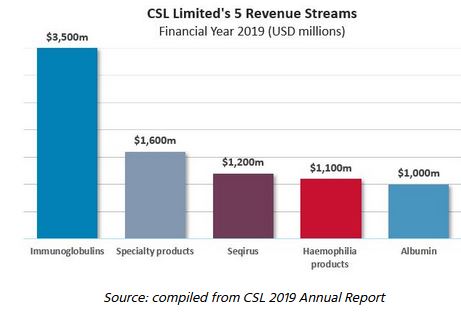

My Foolish colleague Regan Pearson put together this informative graph that shows how the revenues from the two divisions come together (anything that isn't Seqirus is part of the Behring division).

As you can see, Behring is by far the largest division – focusing on a broad range of products for treating rare and serious diseases using blood plasma- and recombinant-derived technologies. CSL lists diseases such as haemophilia, von Willebrand disease and primary immune deficiencies amongst others that its products are used to treat. Behring's largest division works with immunoglobins (part of the body's immune system) to combat autoimmune diseases and other infections.

Seqirus is the vaccine division and focuses mainly on the development of influenza vaccinations, although it still works with antivenoms and other niche product offerings. Its main responsibility is covering the seasonal flu strains that we see every winter (and making sure there is enough effective vaccine to go around) as well as 'pandemic' vaccinations like swine flu. Thus, Seqirus works closely with the Australian government in coordinating its output and is the first port of call if there is ever a potential disease crisis like we saw in 2009 with swine flu.

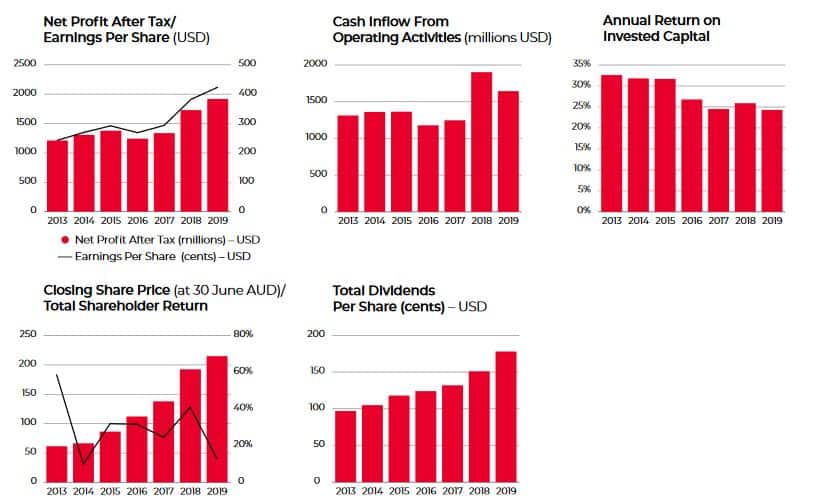

But not only does CSL make medical products essential for modern medicine, it does so whilst delivering a consistent bounty for its shareholders. This is best illustrated by the below graphs:

Source: CSL Ltd Fy19 Annual Report

As you can see, most of the important metrics have a nice staircase pattern. Although returns on invested capital have been decreasing, this is inevitable of a company of CSL's size, and I think its current rate north of 20% is still remarkably impressive.

While I'm not a medical expert, due to ageing populations both here and across other advanced economies (as well as rising middle-classes in emerging markets), I believe the demand for CSL's products will find no shortage of demand well into the future. Due to its long history of excellence, I also have faith that CSL will continue to run its operations in a way that will be of great benefit to its shareholders.

What about CSL's dividends?

CSL is not normally considered a 'dividend stock' but as the above graph illustrates, CSL has been quietly growing its dividend ever since its 2013 inaugural payment. Although CSL (on today's pricing) is only offering a starting yield of 0.92%, investors who picked up CSL shares in 2013 would now be looking at a yield on cost of roughly 4.55% – which is starting to look a lot better!

Even in the 2019 financial year, CSL only paid out 45% of its earnings as dividends. Seeing how much this company is growing, I see this dividend continuing to grow at a similar rate, especially if CSL decides to increase this payout ratio in the future (which, in my view is likely at some point).

This makes CSL one of the best long-term dividend growth plays on the ASX in my opinion.

Foolish Takeaway

From looking at CSL, I think this company will generate massive returns for its investors over the next five years and beyond – both through dividends and capital growth. It's your classic dividend growth stock in a tailwind industry – it doesn't get any better than that.

Although the CSL share price is very expensive at current times, it has always appeared so to the detriment of would-be investors. I think the best approach to get some exposure to CSL is opening a small position and loading up the truck if there is a market crash or similar event.