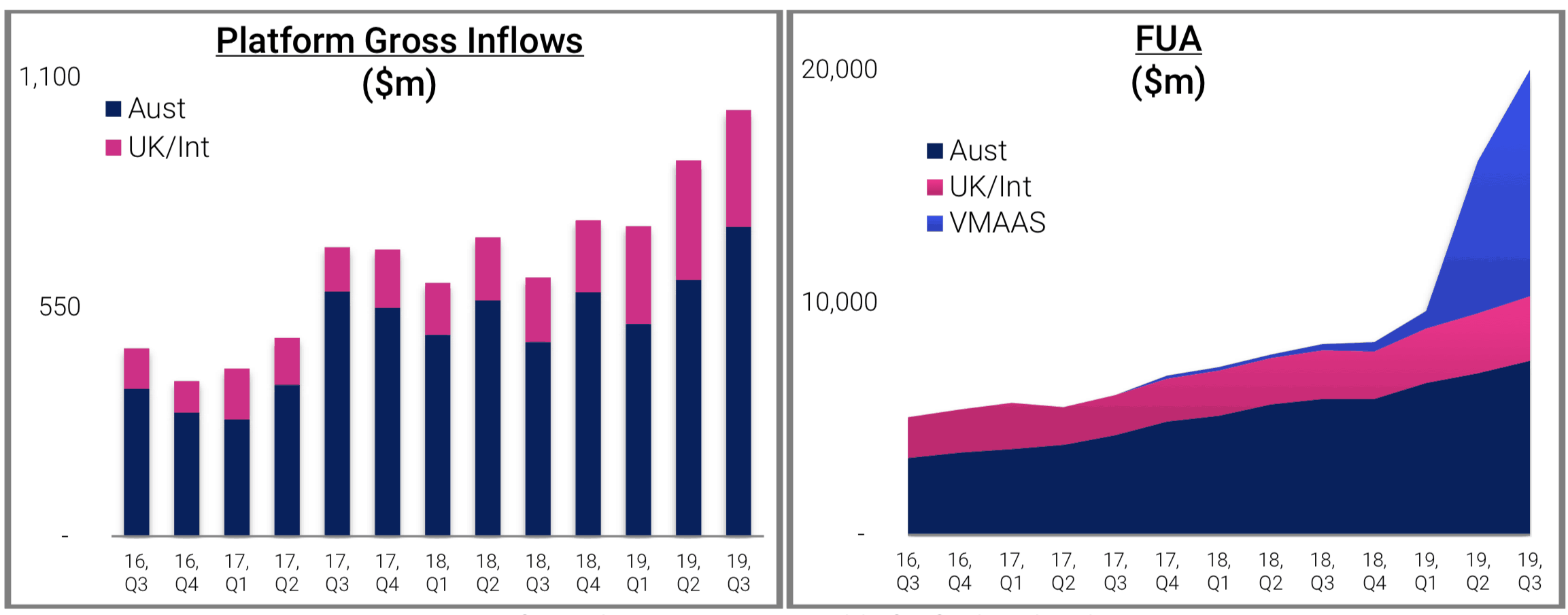

The Praemium Limited (ASX: PPS) share price is up 14% to 52 cents this morning after the funds administration platform produced record quarterly net inflows of $558 million on gross inflows of $1 billion for the quarter ending September 30, 2019.

In total the group now has more than $20 billion in funds under administration (FUA) with $9.3 billion contributed by its non-custodial VMA Administration Service (VMAAS) and the difference contributed by its platforms business that digitally connects financial advisers to their clients and investment portfolios.

The chart below provides a good insight as to how the business has grown since 2016.

Source: Praemium presentation, Oct 14, 2019.

The company is also looking to push into the vast UK private pension market, with UK Self-Invested Personal Pensions (SIPPs) (equivalent to SMSFs in that they have tax breaks, but are easier to administrate) up 89% over the quarter to 1,247 schemes.

The rapid rise of the likes of Praemium, Hub24 Ltd (ASX: HUB) and Netwealth Group Ltd (ASX: NWL) shows how much money is floating around pension markets and the ease with which FUA can be skimmed by intermediaries.

Goldman Sachs has already had a look at Praemium's September numbers and reiterated its 'buy' rating and 62 cents per share price target.

Goldman's analysts are especially impressed by the Austrian FUA flows in what it described as an "overall positive" start to the fiscal year.