A lot of retail share market traders like to pile into whatever's hot or going up fast in the small-cap sector as they're more interested in price action than the merits of the underlying business.

In turn the hot money can amplify the share price movements to create more hype and further share price rises in a multiplier effect.

Serious investors need to be careful though, as small or micro-cap share prices can commonly end up disjointed from reality due to this effect and as social media or stock market chat forums serve to further ramp prices higher.

However, now and then the fast risers are the real deal and if you get in early on huge winners like Afterpay Touch Group Ltd (ASX: APT) or Nearmap Ltd (ASX: NEA) it is possible to make life-changing fortunes. The question for investors is sorting the huge winners from the flashes in the pan.

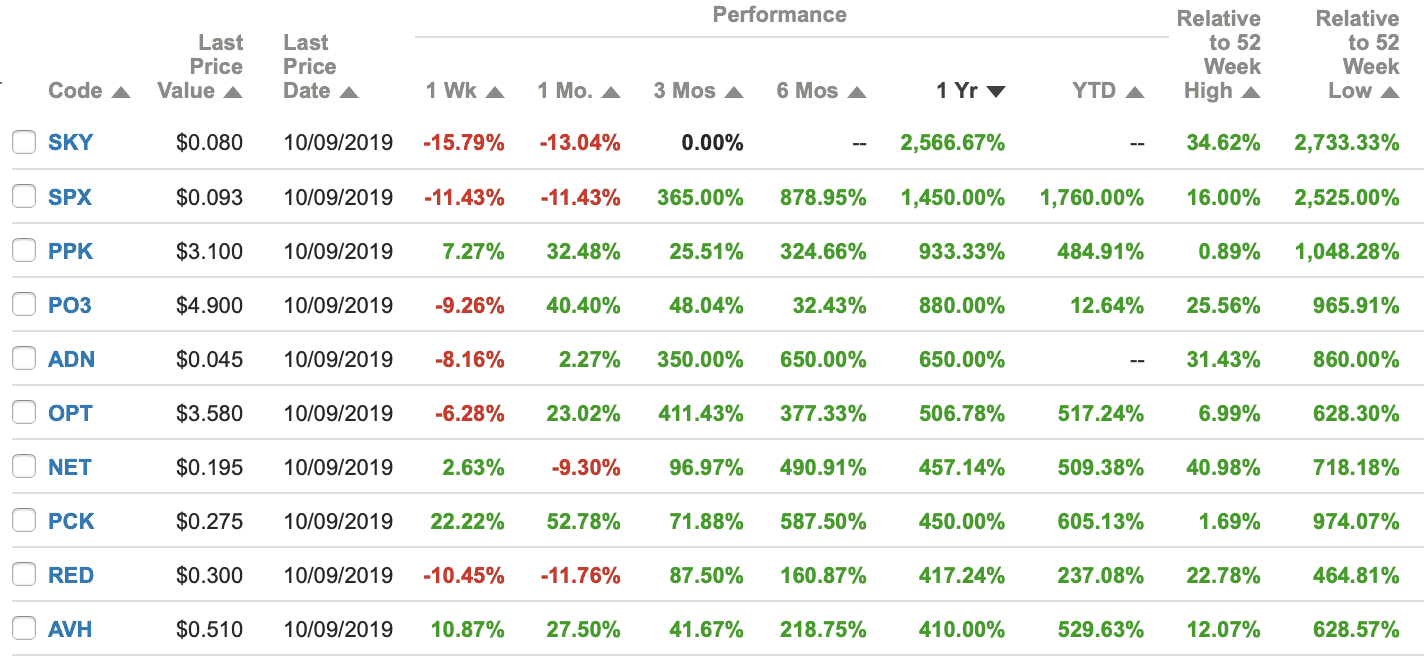

So with this in mind let's take a look at the 10 best-performing small or micro-caps of 2019 according to Commsec.

Source: Commsec, Sept 10, 2019.

Sky Metals Ltd (ASX: SKY) is up 2,566% but only to 8 cents. It's an Australia-based tin exploration and mining company. Based on 250 million shares on issue it has a market value of just $20.4 million.

Spectrum Metals Ltd (ASX: SPX) is a WA-based gold explorer that has climbed 1,450%, but only to 9.3 cents per share. This shows how small movements in penny stocks can produce huge swings in percentage terms.

PPK Group Limited (ASX: PPK) is a mining services group mainly involved in assisting the "high-gas underground coal market".

Purifloh Ltd (ASX: PO3) reports it's developing its 'free radical generator' technology for water and air purification. For fiscal 2019 it reported no sales and a net loss of $3.37 million.

Andromeda Metals Ltd (ASX: ADN) is a gold, lithium and copper explorer. However, it's particular focus for now is developing the Carey's Well halloysite-kaolin deposit in South Australia.

Opthea Ltd (ASX: OPT) is an eye disease therapy biotech that has been exciting investors with announcements over some recent clinical trial results. It now has a market value around $895 million.

Netlinkz Ltd (ASX: NET) reports its a patented online network technology business. It posted an $18.5 million loss on $555,500 in sales over fiscal 2019.

PainChek Ltd (ASX: PCK) is developing mobile medical device applications to help assess pain in patients. It reported a net loss of $3.26 million on sales of $135,000 in fiscal 2019.

Red 5 Limited (ASX: RED) is a mining exploration junior focused on the gold space. It has $24.9 million cash on hand and debt around $10.1 million. Its market value is up to around $370 million on the back of its share price rise.

Avita Medical Ltd (ASX: AVH) develops and sells a range of respiratory and regenerative medicine products. It reported sales up 543% to $7.7 million in fiscal 2019, which largely explains its fast-rising value.