The Telstra Corporation Ltd (ASX: TLS) share price slipped 1.6 per cent to $3.65 in morning trade after it warned free cash flow for FY 2020 is now expected to come in between $3.3 billion to $3.8 billion, which is up to $100 million lower than previously forecast.

This is important principally because free cash flow is used to pay Telstra's cherished fully franked dividends and any updates suggesting they could come in lower than expected in FY 2020 will put the shares under pressure.

Telstra has already been forced to cut its dividend pretty much in half since FY 2017 from 31 cents per share to just 16 cents per share on earnings of just 18 cents per share in FY 2020.

Earnings have plunged thanks to the hole left behind by the NBN, while the competitive environment also pressures mobile margins and average revenue per user (ARPU) as data and phone calls get cheaper.

The NBN Co is again the culprit behind today's mini downgrade as it's pushing back the number of connections to households it plans to make in FY 2020 from 2 million to 1.5 million.

The less connections switched over from Telstra's copper network to the NBN network the less compensation Telstra receives in return, although this is offset to some extent by Telstra taking on lower NBN connection or payment costs for example.

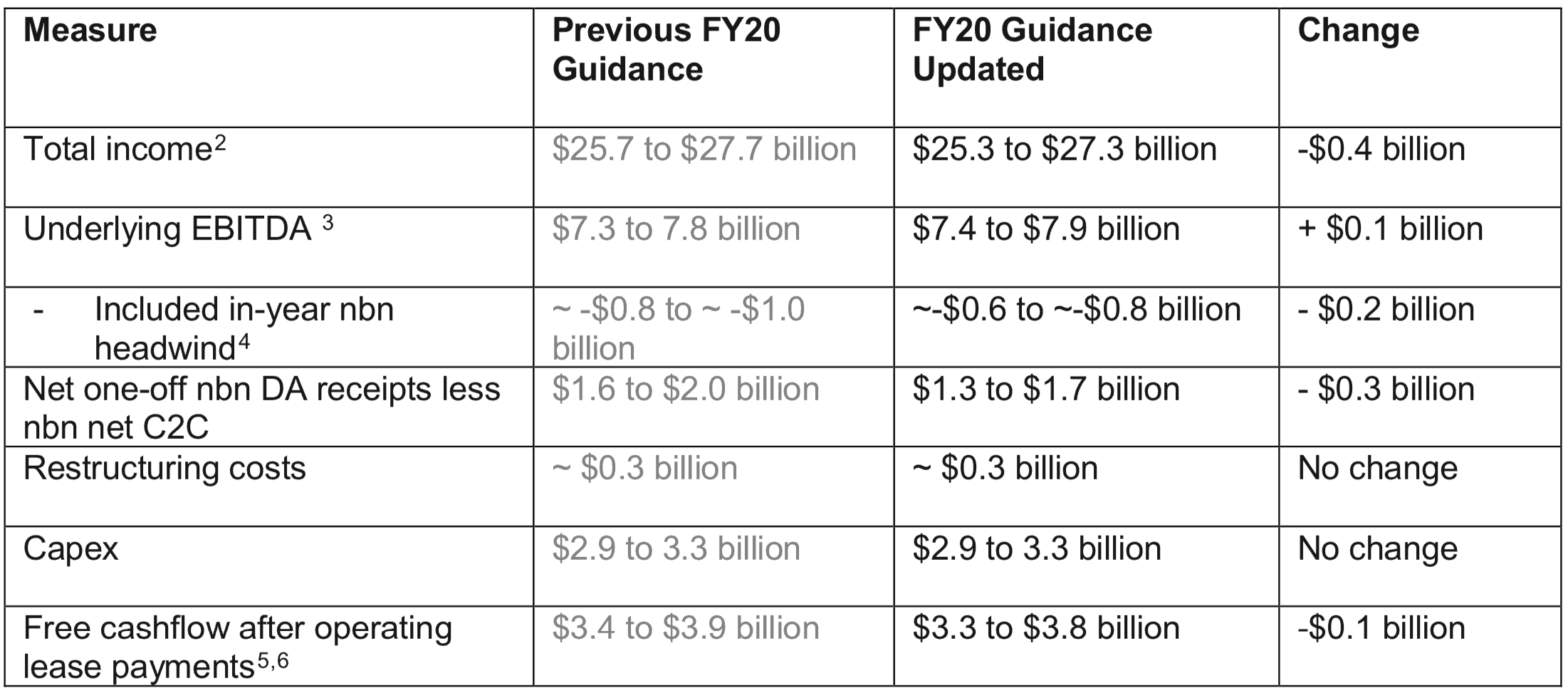

Telstra also provided updated guidance to other key metrics in the table below.

Source: Telstra Presentation, Sept 2, 2019.

For long term investors whether the NBN Co. pain comes more in FY 2020 or FY 2021 is incidental as Telstra's main growth opportunity remains mobile, 5G, and other services or technologies outside the government sponsored NBN Co wrecking ball.

Others crushed by NBN Co. include TPG Telecom Ltd (ASX: TPM) and Vocus Group Ltd (ASX: VOC).