This morning JB Hi-Fi Limited (ASX: JBH) released its results for the financial year ending June 30, 2019. Below is a summary of the results with comparisons to the prior year.

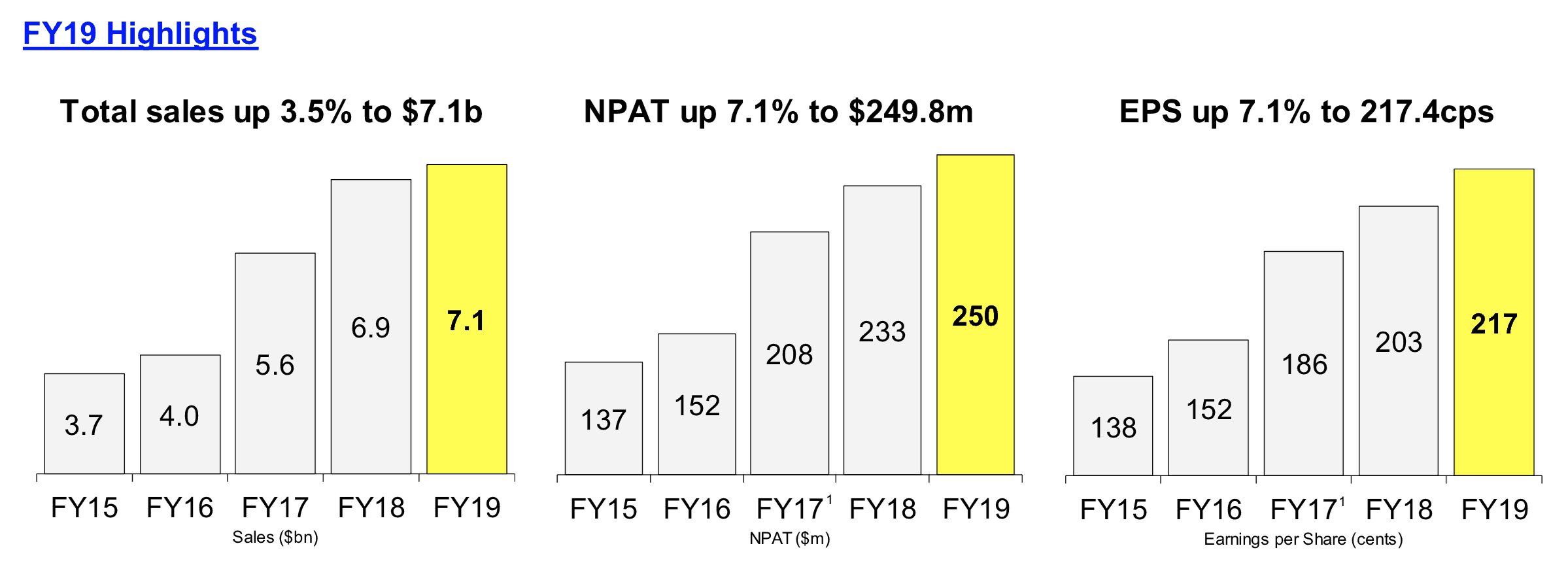

- Total sales of $7.1 billion, up 3.5%

- Net profit of $249.8 million, up 7.1% (ahead of prior guidance up to $245m)

- Earnings per share of $2.174, up 7.1%

- Final dividend of 51cps, total dividends $1.42cps, up 7.6%

- JB Hi-Fi Australia sales $4.73b, up 4.1% (same store sales up 2.8%) online sales grew 23% (FY18: 32%) to $258m

- Good Guy sales $2.15b, up 0.9%

- Net debt $319.9 million

- JB Hi-Fi Australia July 2019 same store sales +3.2%, Good Guys sales store sales -3.4%

- Guides for FY 2020 group sales around $7.25b

This is another decent year of mid-single-digit growth for JB Hi-Fi given the backdrop of weak retail conditions as house price and wages growth stalled across Australia over the reporting period.

The electronics and white goods retailer has an impressive track record of medium term growth while maintaining a reasonable balance sheet with net debt around 0.85x FY 2019's EBITDA of $342.3 million. Below you can see its track record of growth.

Source: JB Hi-Fi presentation, Aug 12, 2019.

Source: JB Hi-Fi presentation, Aug 12, 2019.

The group can grow organically via same-store sales and margin growth, or via new store openings, while its one challenge is rising competition especially from discount online sector players like Kogan.com Ltd (ASX: KGN) and U.S. giant Amazon Inc. in the space.

JB Hi Fi's online sales growth is strong in Australia at 23% over FY2019, but not exceptional and online sales currently represent only 5.5% of total sales.

Therefore investors need to have faith in management's strategy to keep ahead of the competition and JB Hi-Fi appears to have a strong competitive position on the high street from what I can see.

Outlook

In terms of valuation the stock at $27.96 sells for 12.9x FY 2019's EPS with a 5% dividend yield plus full franking credits. Given it is guiding for FY 2020 sales growth around 2.1% it looks reasonable value if we assume it can maintain similar profit margins. If it can grow margins the stock is likely cheap today.

Notably, it has also been heavily short sold for a long time with 14.3% of its outstanding shares shorted as at August 5, 2019.

Given its consistent track record and modest valuation it's no surprise to see the shares long-term trend is higher, with shorting it a generally losing strategy.