As was widely expected by economists and investors alike, the Federal Open Market Committee (FOMC) met overnight and cut U.S. interest rates by 25 basis points to the range of 2% to 2.25%.

Federal Reserve chairman, Jerome Powell, explained:

"In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective."

However, Mr Powell disappointed the market at a post-meeting news conference when he explained that the central bank's rate cut was part of an ongoing move to adjust to economic conditions and warned that there was no guarantee of future cuts.

Will the Reserve Bank follow suit next week?

On Tuesday the Reserve Bank of Australia will meet to decide on the cash rate once again.

Whilst most economists agree that another cut is coming in the very near future, the August meeting appears to be a touch too soon for them.

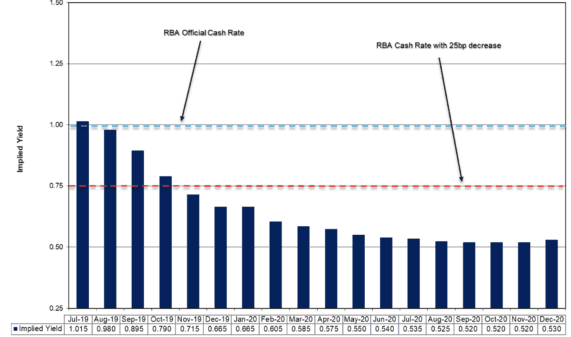

According to the ASX 30 Day Interbank Cash Rate Futures, there is now only a 10% chance of a rate cut at next week's meeting.

As you can see below, the market expects a rate cut to 0.75% in October or November and then a further rate cut to 0.5% around the middle of next year.

In light of this, I think investors ought to prepare for a long period of low interest rates and consider switching out of savings accounts or term deposits into dividend shares such as Lendlease Group (ASX: LLC), National Storage REIT (ASX: NSR), or Scentre Group (ASX: SCG).