Below you'll find two cheap ASX 200 shares I've been mulling over recently – Telstra Corporation (ASX: TLS) and Star Entertainment Group Ltd (ASX: SGR). While shares in either will cost you less than $5, there are complexities at play in both companies. With that in mind, I've decided to approach them both with 'cautious optimism'.

Here's a closer look at Telstra and Star Entertainment's performances this year and whether either (or both) might make a good addition to your investment portfolio.

Telstra Corporation

I've known people who have owned Telstra shares since the day they hit the ASX. It should surprise no one that it's the most widely held stock by Australians. Investors who purchased shares at $7.40 in 1999 as part of the second stage or "T2" of the Telstra's privatisation program won't be happy with today's $3.90 close. The upside is that the share price has been heading in the right direction, achieving a 41.82% increase over the past 52 weeks.

The public's desire for mobile technologies, ever improving internet products and streaming services isn't going to go away. Telstra is the king of the telco market and dominates it across key business segments. It's number one by a long way in mobile phone and internet service delivery, with room to grow.

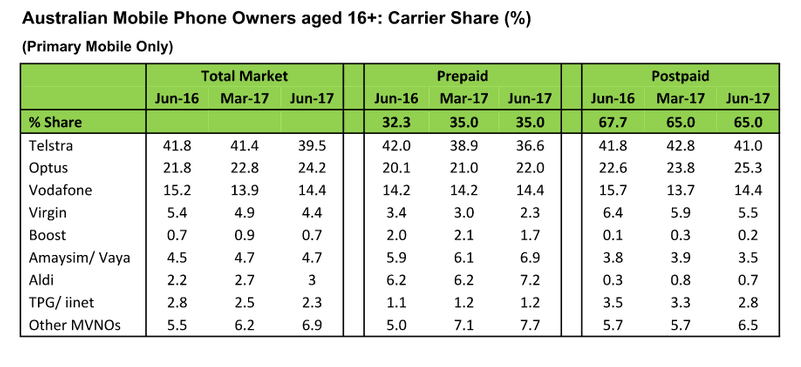

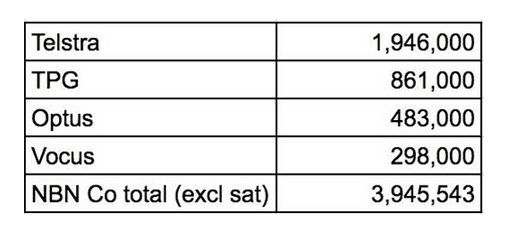

The chart above highlights Telstra's dominance of mobile phone ownership, and the chart below demonstrates its lion's share of new NBN connections.

NBN Activations in FY 2018

Market dominance puts Telstra in the box seat to integrate future technologies, including 5G and whatever new technologies will come afterward. Investors receive a fully franked dividend, which currently sits at 3.25% yield with long term observers predicting that rate to move above 4% in the near term.

Star Entertainment Group Ltd

Star Entertainment operates casinos and associated leisure and hospitality services in Queensland and New South Wales, but it's been a lacklustre year for the company so far, culminating in a downgraded EBITDA forecast in early June. External economic headwinds and capital works at The Star Sydney casino were the reasons offered for customer disruption.

Star Entertainment's share price closed today at $4.12, but it may be worth waiting and watching a little longer before you hit the "buy" button. Neither issue mentioned above has gone away; however, capital developments point to some potential growth as several projects are due to be completed in the coming years. The Queen's Wharf development on Brisbane's iconic riverfront will be a game changer in terms of a new entertainment precinct in the CBD.

Additional investment on the Gold Coast, in partnership with Chow Tai Fook and Far East Consortium, to build a hotel and residences will go ahead based on market conditions. Finally, the completion of the capital works at The Star Sydney will open new and upgraded services and venues.

Dividend hunters could be cautiously optimistic that the current fully franked dividend yield of 5.64% might have some room for improvement as the capital developments come to fruition.

Foolish takeaway

Some investors will take a pause before buying shares in either Telstra or Star Entertainment. In Telstra's case, the more you research the more you'll find a huge diversity of opinion on its value and prospects. It can be difficult to reach a clear decision.

In respect to Star Entertainment, there's no shortage of evidence that problem gambling damages our communities and ruins lives. It's also fair to say that most of us can enjoy a game of blackjack and a good night out at the casino without developing an addiction to gambling.

In both cases, it's your portfolio and your decision. If you'd like to take a few minutes to read Star Entertainment's responses and policies in this area you can read them here.