Is the Nanosonics Ltd (ASX: NAN) share price a buy?

Nanosonics manufactures and distributes its breakthrough disinfection product used for ultrasound probe reprocessing. The share price is up a whopping 65% this year and I believe it can go a whole lot higher. Here is why I believe Nanosonics can outperform the S&P/ASX 200.

Let's start with the market opportunity at hand. Nanosonics is still in its early days of growth and development given the significant global opportunity in the ultrasound probe reprocessing market. The abstract (below) from the company's HY19 presentation highlights only 16% market penetration despite strong year-on-year installations.

The company's flagship product, the Trophon has already become a staple standard of care in Australia with approximately 70% market penetration. However, in regions such as Europe, the Middle East and Asia, there remains a significant opportunity.

In 2019, a preliminary clinical study found that over 90% of probes in Japan were contaminated. Of the contaminated probes, over 50% were found to harbour potentially pathogenic bacteria. This is a key opportunity for Nanosonics as they highlight "our business development activities in Japan progressed positively with completion of the first clinical study and establishment of Nanosonics Japan". With regulatory approval in place in Japan and pre-marketing strategy underway, Nanosonics could be set for some explosive growth in the coming years.

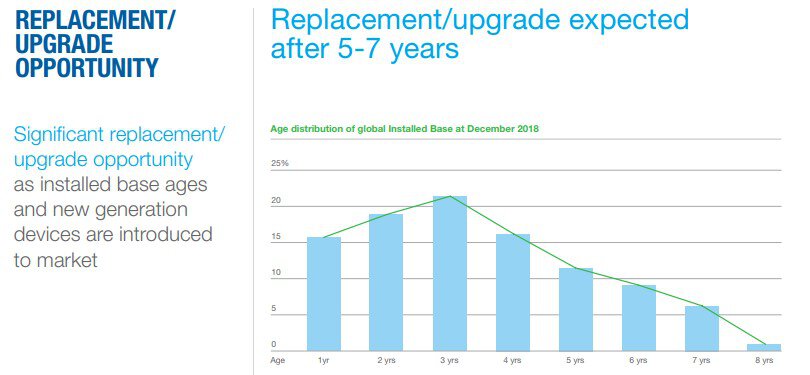

Nanosonics also has a diverse business model that involves capital equipment sales, equipment maintenance and rental services. Given the company's strong position in the market, the concept of equipment replacements and upgrades presents a significant, almost annuity style of revenue.

I am confident that Nanosonics' geographical expansion, strategic partnerships and distribution channels will continue to pay dividends to its bottom line.

Is the stock too expensive?

Strong historic growth, a diverse revenue model and many significant global opportunities – it seems too good to be true. Surely there is a twist?

Well, Nanosonics trades at a P/E ratio of around 110. This could be comparable to the way NextDC Ltd (ASX: NXT) is priced, with a P/E ratio of 330. Both companies are incredibly reliable in earnings growth and possess a market leading product that will be highly sought after for many years to come. The market has therefore priced in much of the anticipated upside.

Foolish takeaway

Nanosonics continues to deliver on growth with its half-yearly and annual reports. Clearly, the company still has a long way to go in its global expansion and ongoing R&D. The company anticipates a second clinical study in Japan to be completed by the end of FY19 and regulatory approval of the Trophon 2 expected by the end of FY19. I would strongly consider adding Nanosonics into a portfolio aimed at capital growth.