The AfterPay Touch Group Ltd (ASX: APT) share price is down 3.5% to $23.30 today despite the buy-now-pay-later operator not releasing any specific news to the market.

AfterPay's growth has been so strong that it's now repeatedly on the syllabus of MBA students at Harvard University with its route to viral growth in the U.S. turbocharging its share price over the last 12 months.

It has also recently launched its Clearpay business in the UK, which is also a far larger market than Australia with AfterPay basically using the same tech and sales strategies as it did in Australia in an attempt to replicate its success.

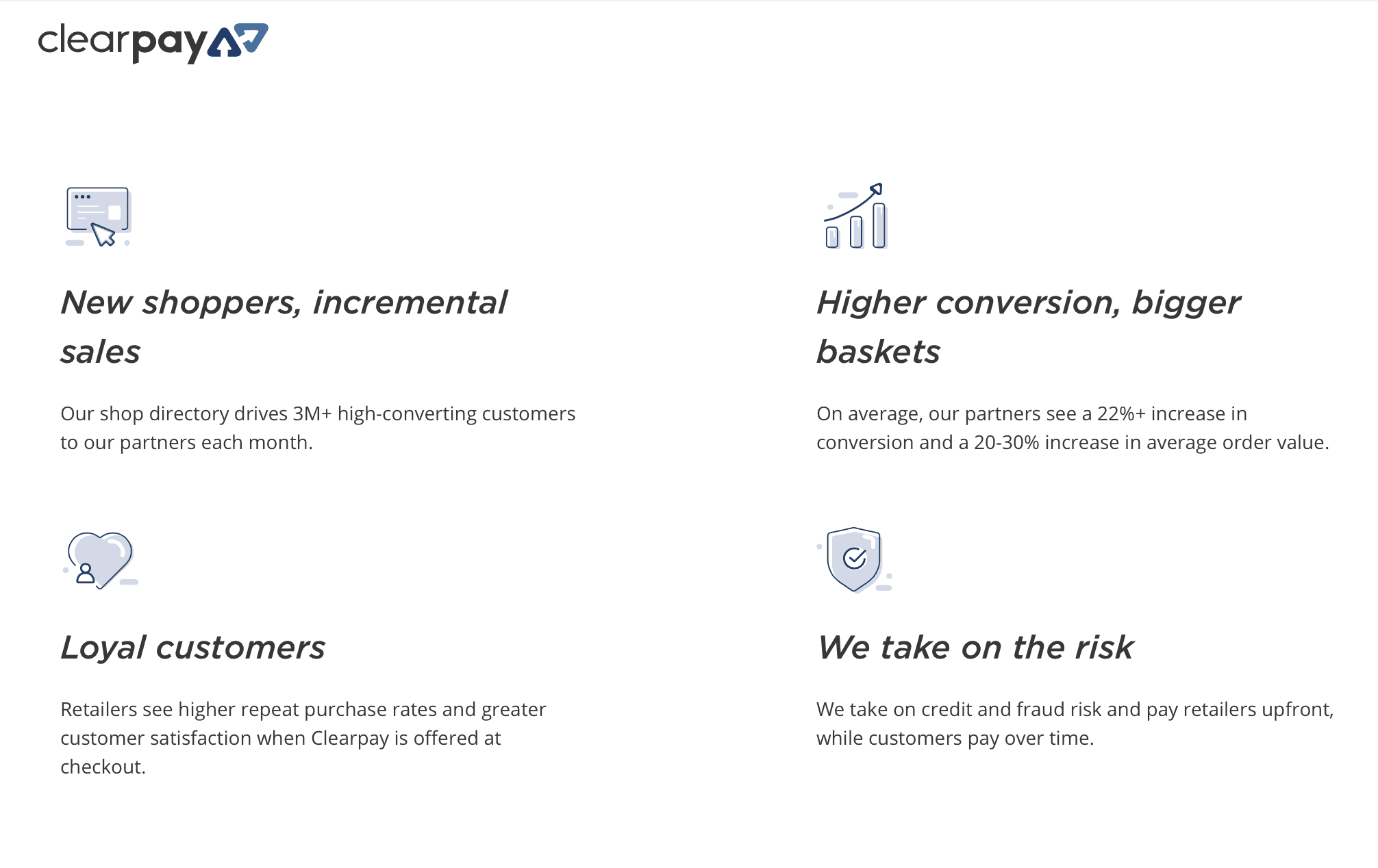

Below we can see a screenshot of its Clearpay website's pitch to get retailers to sign up to its services in the UK.

Source: Clearpay website, June 3 2019

The website's pitch shows how Afterpay's secret sauce is that it helps retailers win market share, while lifting sales and average basket share at no credit risk to the retailer.

So it's not hard to see why retailers raced to sign up to its product in Australia and the US.

Of course such a successful business model is likely to attract competition that varies in credibility from main rival to Z1P Co Ltd (ASX: Z1P) to the not so credible start-ups such as Splitit Ltd (ASX: SPT).

Outlook

Either way the main risk to its business model as I see it is a deep-pocketed competitor offering retailers lower fixed fees in an attempt to win market share. For example we've seen how a group like WeWork has disrupted the fast-growing shared office sector and the likes of Servcop Ltd (ASX: SRV) despite Wework posting huge losses every year. While the aggregated food delivery sector has also seen ferocious competition amongst deep-pocketed loss-making start-ups such as UberEats, Deliveroo and Foodora.

AfterPay Group is also vulnerable to this race to the bottom type scenario that could see it struggle to deliver meaningful profits. In other words it does not have much of a moat or competitive advantage to impress a Warren Buffett type investor, but in fairness this is not unusual for a start-up fintech business and does not mean it cannot go onto be a huge success. As everyone has to start somewhere.

Overall though investors should remember AfterPay's valuation at $23.50 already has a heap of future success baked in and as such I wouldn't rate the shares any better than a hold for now.