The share prices of Australia's two ASX-listed funeral operators, InvoCare Limited (ASX: IVC) and Propel Funeral Partners Ltd (ASX: PFP) are rising from the grave.

Since the middle of January, the Propel share price has risen 31.4% and since the start of the year the InvoCare share price is up 56.8%. Are these performances short-term walking zombies or should investors feel like they're in heaven?

Why are the InvoCare and Propel share prices on the rise?

According to a report in the Australian Financial Review, the investor excitement is justified with a rising number of flu deaths after a benign flu season in 2018. According to the CEO of Propel, the peak flu season is from June to October.

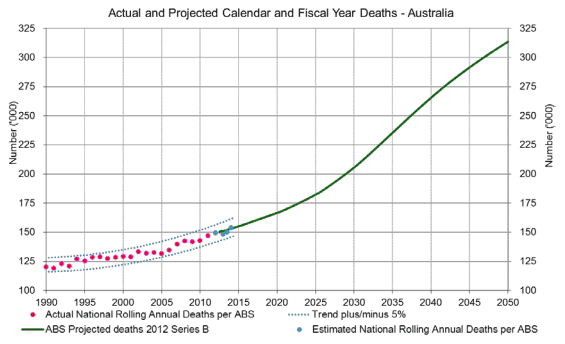

What's true for both businesses is that they are exposed to an ageing population tailwind that inevitably and sadly leads to projected rising death volumes, as illustrated in the graph below:

Numerically, death volumes are expected to grow by 1.4% per annum between 2016 to 2025 and then increase by 2.2% per annum from 2025 to 2050.

I do not enjoy the fact that death volumes are rising. I would prefer that people get more time with their family, but it's also true that funeral prices keep rising over the years, so the funeral operators do benefit from people living longer as well with higher revenue.

Foolish takeaway

The only two things certain in life are death and taxes, but it's hard to directly benefit from taxes unless you work at the ATO or you're an accountant.

InvoCare is trading at 28x FY20's estimated earnings and Propel is trading at 23x FY20's estimated earnings. Propel is obviously cheaper, but I like InvoCare's strategy of upgrading its locations and it has a high return on equity, so InvoCare would be my pick of the two.