The Class Ltd (ASX: CL1) share price is only up 0.5% today at $1.685 despite the superannuation platform provider releasing a reasonably positive trading update.

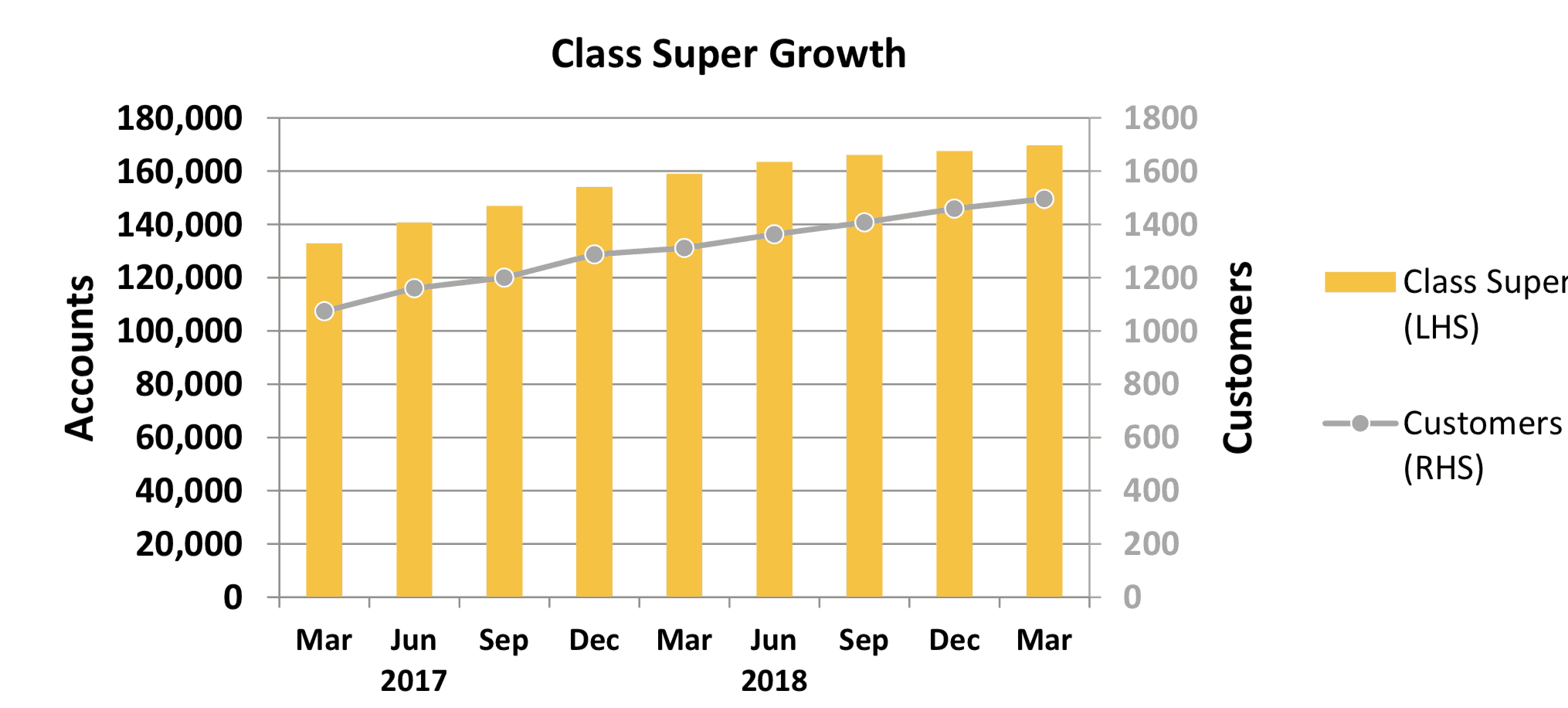

For the period ending March 31 2019 Class added 2,409 new investor accounts to 176,621 and total Class customers increased by 36 to 1,506.

Source: Class Presentation April 2, 2019.

As we can see Class is delivering consistent customer growth, but the stock is down around 23% over the past year on the back of investor disappointment that competition is rising, after AMP Limited (ASX: AMP) for example decided to try and take the platform product in house.

For the six-month period ending December 31 2018 Class posted a net profit after tax of $4.4 million on sales of $19 million, with the profit and sales up 2% and 12% respectively.

Class's new CEO, Andrew Russell, is also expected to start the top job on May 14 2019 and will be tasked with returning it to its former market darling status despite an increasingly competitive market.

Other successful and fast-growing players in the financial platform space offering other products include Hub24 Ltd (ASX: HUB), Netwealth Ltd (ASX: NWL) and Praemium Ltd (ASX: PPS).