Term deposits aren't the most interesting investment in the world, and rank only slightly above savings accounts in terms of possible returns – but could they be the key to improving your personal finances?

What are term deposits?

Term deposits (TDs) allow investors to give their cash to a financial institution (i.e. a bank) for a fixed rate of time (i.e. 3, 6 or 12 months) in exchange for an agreed rate of return on that investment.

That rate of return will vary depending on the financial institution chosen and the period of time that your money will be tied up for (illiquidity premium).

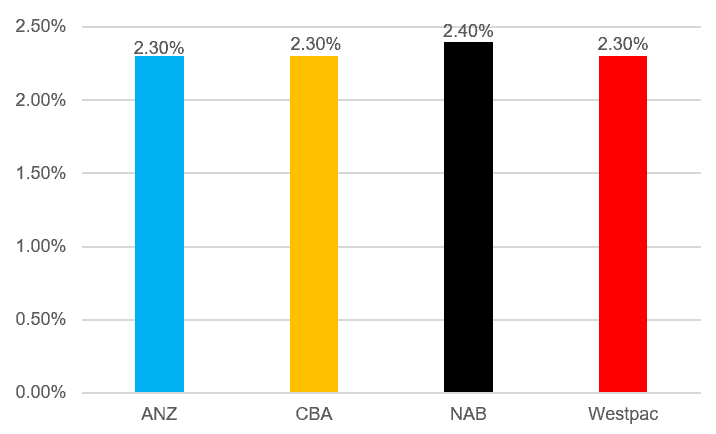

A comparison of current major bank TD rates (per annum) is shown in the chart below:

As you can see, the rates offered by the major banks aren't exactly shooting the lights out and actually sit below many of the introductory rates available on Australian high-interest savings accounts (HISAs).

The Bank of Queensland Limited (ASX: BOQ) offers the best long-term TD rate on the market at 2.65% p.a., which unlike the HISAs can lock in the return for the entire investment period (i.e. 12 months) rather than being a 4-month introductory variable rate.

TDs are an ideal investment for those that are willing (and able) to part with their money for an extended period of time and has the added benefit of locking up that cash to prevent unnecessary spending.

While 2.30% – 2.40% may not seem like much, in a low-interest rate environment, it does offer 80 – 90 basis points of value over the 1.50% RBA cash rate. With the right amount of self-control and a decent deposit, TDs can lock-in returns and provide an inflation hedge rather than just parking the cash in low-yielding savings accounts or worse – cash.

In my opinion, TDs provide an easy solution for investors not willing to set up and maintain an active account rollover strategy to get the most out of the introductory HISA rates.

While I don't personally invest in term deposits, I think the reliability of the Australian banks and effectively guaranteed returns can provide significant upside for your nest egg prior to investing in a more high-yield investment like real estate or expanding that ASX share portfolio.