The Northern Star Resources Ltd (ASX: NST) share price has risen 36% in the last year, but if you've been thinking of buying shares in the gold miner for its growing, fully franked divided, there are a few things you need to know today.

The first is that shares will go ex-dividend this week on Wednesday March 13, 2019. The 'ex-date' is when the shares start selling without the value of its next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Thursday April 4, 2019.

What is Northern Star Resources' dividend yield?

At its recent half-year results, Northern Star declared an interim dividend of 6 cents per share for the six months to 31 December 2018. This was up 33% on the same period last year and gives the miner a trailing dividend yield of 1.2%, fully franked.

Is the dividend sustainable going forward?

Northern Star Resources has an interesting dividend policy that plans to distribute 6% of its revenue to shareholders after each financial half-year.

It's an approach that the company thinks strikes balance between income and growth for shareholders and offers cash returns throughout the cycle of commodity prices.

This certainly feels sustainable in the short term. Northern Star has essentially no debt, holds a huge pile of cash on its balance sheet and has production guidance of between 850,000 and 900,000 ounces for the full 2019 financial year which would be growth of up to 56% on 2018.

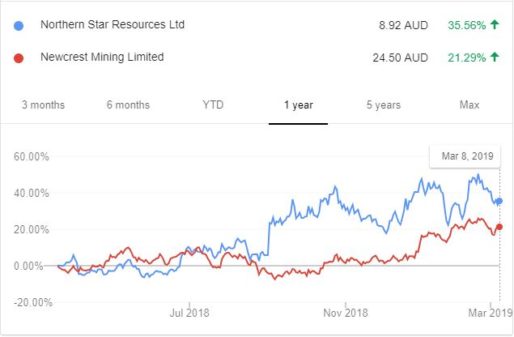

This helps to explain the company's rapid share price rise which has far outpaced fellow gold miner Newcrest Mining Limited (ASX: NCM) over the last 12 months.

Source: Google Finance

Northern Star looks to be in a position to lift its dividend substantially over the next 12 months, but I feel like this is already factored into the current share price. Although it would certainly be my preferred gold miner to own today for its excellent management team, I personally struggle with the lumpy investment profiles and unpredictable pricing that commodity producers face.