The Hansen Technologies Limited (ASX: HSN) share price fell 0.65% on the ASX today to close at $3.05.

If you've been thinking of buying shares in the billing software company for its consistent, fully franked divided, there are a few things you need to know today.

The first is that shares will go ex-dividend on Wednesday March 6, 2019. The 'ex-date' is when the shares start selling without the value of its next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The Hansen Technologies dividend will then be paid on Friday, March 29, 2019.

What is Hansen Technologies' dividend yield?

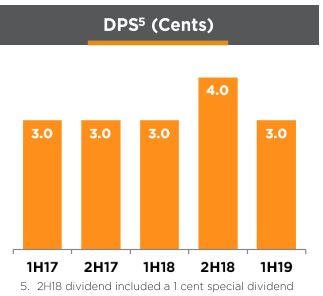

At its recent half-year results, Hanson declared a dividend of 3.0 cents per share for the half year. This was flat on the same period in 2018 and, if we ignore the special dividend of 1 cent per share paid in September 2018, at the current share price of $3.05 per share offers a trailing dividend yield of 2.0%, fully franked.

Source: Hanson Technologies 1H19 presentation

Is the dividend sustainable going forward?

This is a great question to ask before buying any company for its dividend.

At the company's half-year update last month Hanson presented net profit after tax (NPAT) of $12.9 million for the six months to 31 December 2018, down -28% on the same period in 2017.

Cash flow from operations was also down notably as the company took less project-based 'non-recurring' revenue during the period. This is certainly less than ideal if we are looking for growing, long-term dividends.

Looking forward Hanson is expecting overall operating revenue in the 2019 financial year to be slightly below that of 2018, while costs are expected to be similar, suggesting lower full-year profitability.

With no clear signs of a growth trajectory and with a dividend yielding just 2% I would not be including Hanson on my own dividend buy-list today. One company I prefer for its higher dividend yield and long-term growth potential is fellow billing company Gentrack Group Ltd (ASX: GTK).

There are also several other companies going ex-dividend on March 6 to consider, including: