The S&P/ ASX 200 (ASX: XJO) is up 0.2% today and up close to 6% since Christmas as investors' hopes build that the U.S. will permanently remove tariffs (largely reciprocated by China) imposed on the import of certain Chinese goods.

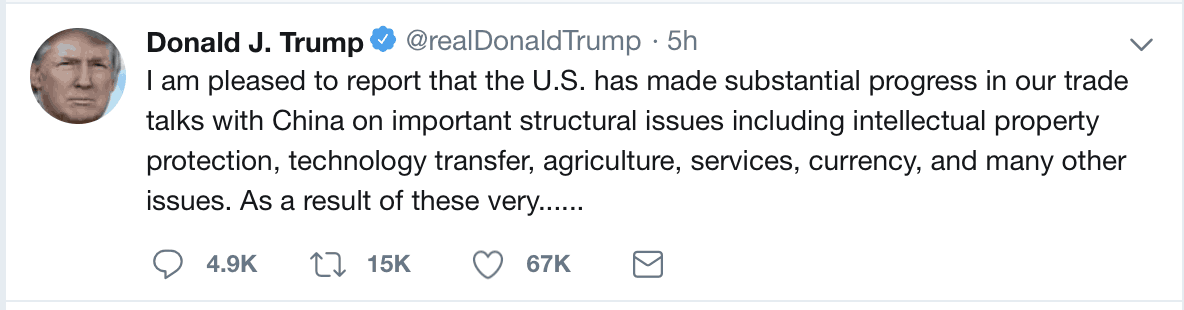

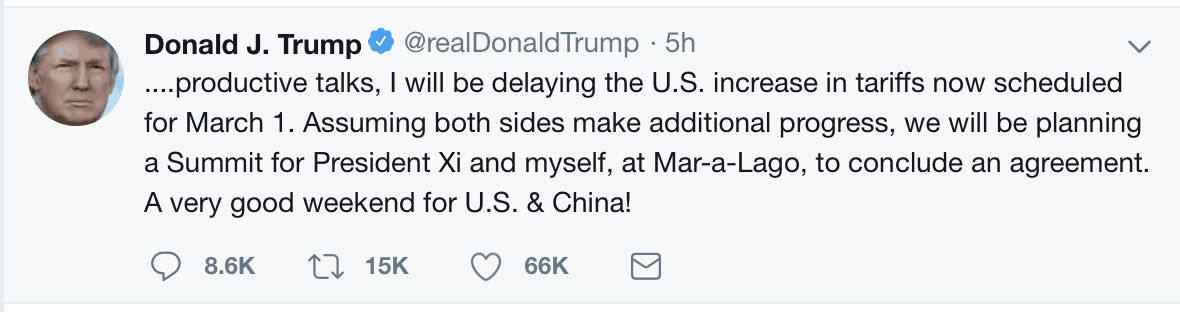

As it stands President Trump has threatened to lift the US's tariffs on $200 billion worth of Chinese imports from 10% to 25% on March 1, but has now decided to delay the higher tariffs ahead of a planned summit with China's leader to "conclude an agreement".

Source: President Trump, Twitter, Feb 25.

If the US and China agree a trade deal then a twin obstacle to economic growth in both nations is likely removed, with markets operating on confidence and sentiment over the short term as much as anything else.

Over the long term however share prices will always follow profits, dividends, and revenues either higher or lower which means investors should focus on looking for growing companies on reasonable valuations irrespective of global politics.

This ASX earnings season has shown how strong profit and dividend growth will lift share prices more than anything else, just consider the 20%-30% uplift in valuations from the likes of Webjet Limited (ASX: WEB), Magellan Financial Group Ltd (ASX: MFG) and Altium Limited (ASX: ALU).

The lesson for investors then is to try to ignore the noise as following it can lead to you selling low and buying high, when a more disciplined long-term earnings-oriented approach will deliver far stronger results.