The Westpac Banking Corp (ASX: WBC) share price is 1.2% higher to $26.30 today, while shares in National Australia Bank Ltd (ASX: NAB) and Australia & New Zealand Banking Group (ASX: ANZ) are marginally lower.

According to reports in the News Corp (ASX: NWS) press Bell Potter's banking analyst has slapped a buy and a $28.50 share price target on Westpac shares and claimed that "much of the negativity" around bank shares is already priced in.

If Westpac shares reach Bell Potter's valuation investors will make around 8.4% plus any dividend payments, so let's consider a few reasons why Westpac shares might be a buy.

- Negativity is high surrounding the banks at the moment due to; the bank levy, falling house prices in Sydney and Melbourne, The Royal Commission findings, and other scandals including the Bank Bill Swap Rate rigging. Poor sentiment towards otherwise strong businesses can often produce good long-term buying opportunities.

- Dividends – Westpac has maintained its interim and final dividend per share at 94 cents since 2016, which means it offers a trailing yield of 7.1% plus full franking credits. This suggests the market is expecting slight dividend cuts ahead, but the bank should still offer today's investors a healthy income stream.

- House price falls in Sydney and Melbourne may reverse in 2019. The prudential regulator may step into loosen investor lending restrictions, while state and federal government have plenty of room to change taxes and legislation to support residential markets.

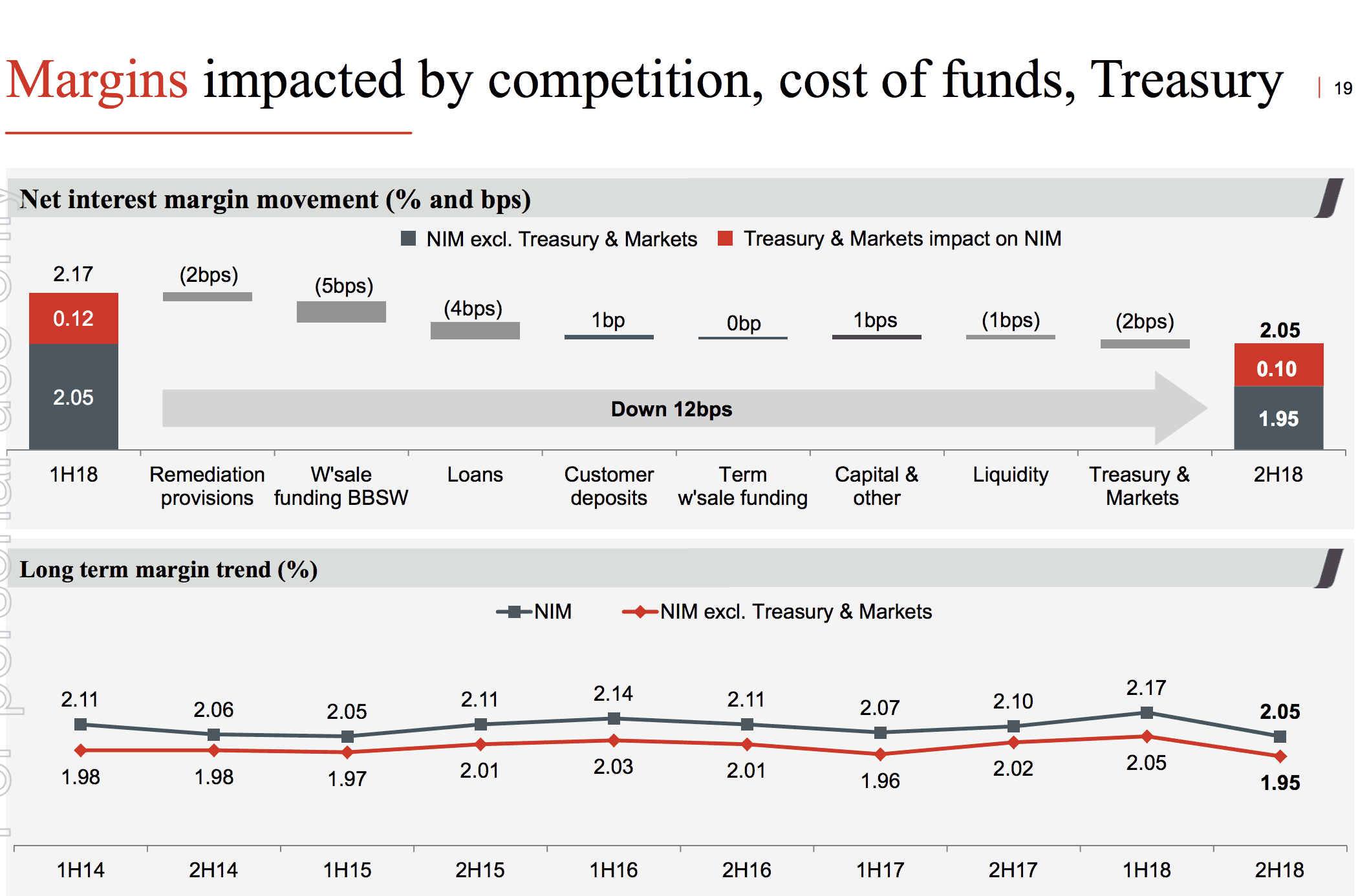

- In the most recent half year Westpac's net interest margin, as a key measure of profitability, hit its lowest levels since 2013 or before. While it could get worse that's unlikely to happen unless the bank chooses not to pass on higher costs to borrowers.

Source: Westpac Bank presentation, November 5 2018

- Despite the falling NIM, Westpac still enjoys a dominant competitive position thanks to the high barriers to entry in Australia's banking industry.

- Westpac also runs its business banking, institutional banking, New Zealand business and has an ownership interest in funds management group Pendal Group Ltd (ASX: PDL). This gives its profit streams a lot of diversity.

Foolish takeaway

Clearly the banking sector is facing some issues around house prices and rising bad debts, but arguably this is now priced into shares. Many investors will probably prefer to hold off on bank shares for now though, in the expectation of cheaper prices in 2019.