The A2 Milk Company Ltd (ASX: A2M) share price and Bellamy's Australia Ltd (ASX: BAL) share price have been among the best performers on the market on Thursday.

In early afternoon trade the a2 Milk Company share price is up almost 9% and the Bellamy's share price is 5.5% higher.

The Blackmores Limited (ASX: BKL) share price is also climbing notably higher and is up 5% at the time of writing.

Why are these shares racing higher today?

Investors have responded positively to news out of China in relation to tough new e-commerce laws.

According to the Chinese government website, the State Council has decided not to implement new e-commerce laws on January 1 and will instead refine its existing policies.

There had been concerns that these new laws could have impacted the sales of exporters like a2 Milk, Bellamy's, and Blackmores.

What is happening on January 1 now?

From January 1 the Chinese government will extend the current Cross Border E-Commerce (CBEC) policy framework. This means that imported items will continue to be viewed as "Personal Use" items and will not require registration or first import licence approval.

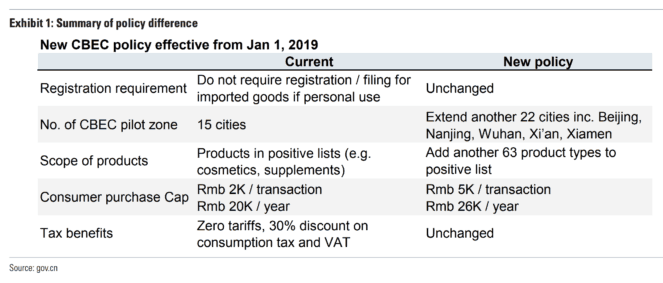

In addition to this, tax benefits and transaction limits remain favourable. According to a note out of Goldman Sachs, imported items through the CBEC channel will continue to enjoy tax benefits and the personal transaction limit will increase to RMB5000 from RMB2000 for a single transaction and to RMB26K from RMB20K for the annual limit.

Below is a quick summary of the changes.

Is this good news?

I believe this is a big positive for companies exporting to China and takes that element of doubt out of the equation. Because of this, I can't say I'm surprised to see the shares of a2 Milk, Bellamy's, and Blackmores surge higher today.

I felt a2 Milk Company and Bellamy's were buys prior today, but this news just sweetens the deal now in my opinion.