The Treasury Wine Estates Ltd (ASX: TWE) share price has taken a tumble on Wednesday and found itself amongst the worst performers on the local market.

At lunch the wine company's shares are down almost 5% to $15.43 following the release of export data from Wine Australia.

What data was released?

This morning Wine Australia released its export data for the 12 months ended September 30.

The data showed that Australian wine exports continued to experience strong growth in both value and volume over the 12-month period. The value of wine exports during the period increased 11% to $2.71 billion, whereas volume lifted 5% to 842 million litres.

In addition to this, shipments of bottled wine increased by 8% in value to $2.16 billion and 2% in volume to 366 million litres. There was also growth in shipments of unpackaged wine during the 12 months. These grew 23% in value to $525 million and 9% in volume to 468 million litres.

One final positive was the increase in the average value of wine exported. The data shows that this increased 7% to $5.90 per litre for bottled wine, 13% to $1.12 per litre for unpackaged wine, and 5% to $3.21 per litre for all wine exported.

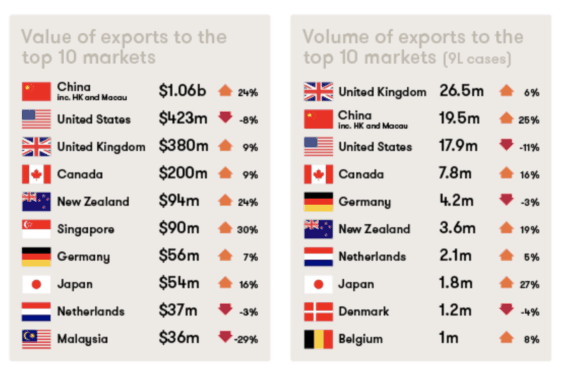

According to the data, the strong performance was driven by growth in all but one major export destination. Northeast Asia was the star of the show with a 24% increase in exports to $1.14 billion. This offset a disappointing performance for U.S. exports which experienced a $38 million decline. This can be seen on the table shown below.

It appears to be the decline in U.S. wine exports that has sent the Treasury Wine share price tumbling today. This is a big market for the company and is expected to be a key driver of future growth.

However, given that management last week reiterated that it was on track to reach its target of 25% profit growth in FY 2019, I think today's selloff has been unnecessary.

In light of this, I think this could potentially be a buying opportunity for investors that are prepared to hold its shares for the long term.

Elsewhere in the industry, Australian Vintage Limited (ASX: AVG) and Broo Ltd (ASX: BEE) shares are flat, while Gage Roads Brewing Co Limited (ASX: GRB) shares are down 4.5% today.