In morning trade the HUB24 Ltd (ASX: HUB) share price has stormed higher following the release of its first quarter update.

At the time of writing the investment and superannuation platform provider's shares are up 4% to $12.43.

How did HUB24 perform in the first quarter?

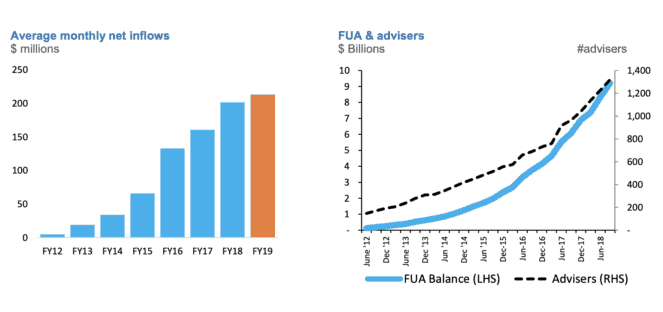

HUB24 has had a fantastic start to FY 2019 and reported record first quarter net inflows of $638 million. Approximately 74% of the net inflows were received into HUB24's retail products, with the other 26% going into white label versions of the platform.

Strong flows from existing advisers as well as initial flows from new relationships were behind the positive performance.

According to the release, this strong growth meant that the company maintained its position as the "fastest growing platform provider on an annual basis both in percentage terms and as a ratio of net inflows to overall share of market".

As you can see below, funds under administration (FUA) climbed to $9.1 billion at the end of the quarter, which is a 50.5% increase on the prior corresponding period.

Another highlight during the quarter was the addition of 92 new advisers to the platform and the signing of 18 new licensee agreements. Management believes that these new agreements and advisers will underpin its strong new business pipeline.

Also supporting its future growth will be a partnership with Challenger Ltd (ASX: CGF) to provide Challenger Annuities on the HUB24 platform leveraging the ConnectHUB technology. The joint development is underway and the solution is expected to be available during the second half of the 2019 financial year.

Should you invest?

I thought this was an impressive quarter from HUB24 and was pleased to see that net inflows are still growing strongly despite the growing competition from the likes of Praemium Ltd (ASX: PPS), Onevue Holdings Ltd (ASX: OVH), and Westpac Banking Corp (ASX: WBC).

Unfortunately, this update doesn't provide any details on profits or margins. So, while I think HUB24 could be a great buy and hold investment, it may be worth keeping your powder dry until its AGM next month. I expect at that meeting the company will provide more colour on its first quarter financial performance.