If you are looking for someone or something to blame for the recent ominous market sell-off, you will need to look overseas.

The S&P/ASX 200 (Index:^AXJO) (ASX:XJO) index looks poised to extend the 3% dive from last week as investors will likely refrain from buying the dip ahead of the weekend when US President Trump could announce a massive step-up in his trade war with China.

This could provide the bears with an excuse to extract revenge given the gravity defying performance of global share markets, including ours, that has seen short-sellers nursing painful losses (click here for more on this).

But the US$200 billion in fresh tariffs is only the trigger. The real threat to the advance of the ASX is something more sinister – euphoria.

The high that investors are feeling is more an issue in the US than it is here, and this has historically been a precursor to a market correction.

Our nation's economic wagon may be hitched to China but there's little chance we will escape unscathed from a significant pullback on the S&P 500.

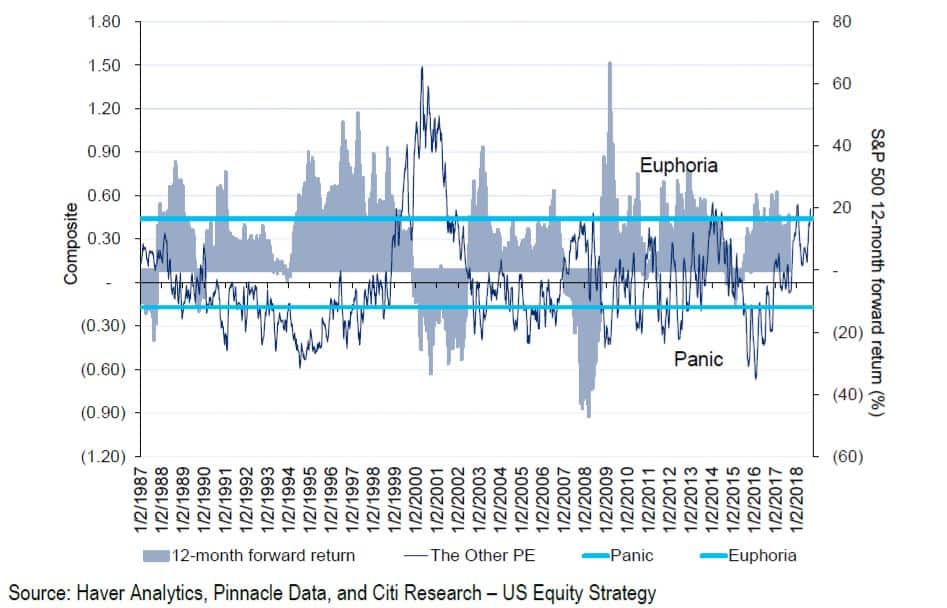

Citigroup warns that a risk or a deeper sell-off, or even a bear market, has increased significantly as its proprietary "Panic/Euphoria" model is flashing a warning sign as investors' sentiment has reached euphoria.

The last time this the model hit euphoric levels in January and early February this year, the S&P 500 tumbled on wage pressures. This concern hasn't abated and this time round the US stock benchmark could fall a further 5%-plus.

Getting High: Citi's Panic/Euphoria gauge flashing red

"In essence, five of the nine inputs [into the Panic/Euphoria model] have pushed the gauge into worrisome territory," said Citigroup.

"At these levels, there's a 70% chance of the S&P 500 being down 12 months from now, which is more than three times the random probability of losing money."

Goldman Sachs is also waving the red flag as its own bull/bear market indicator has reached dangerous levels, according to a report on Bloomberg.

This doesn't necessarily signal the end of the bull market, but the broker said that investors should be prepared for lower returns following the nine-and-a-half-year bull run on the S&P 500 that has generated 19% annual gains.

Goldman's bull/bear indicator has a close correlation with the forward returns on the market benchmark since 1955 and has correctly picked the peak in the market during the last two bear markets.

A bear market refers to a drop of at least 20%, and I am not predicting that we are heading into one. If anything, I suspect we can make one more push higher after the current pullback.

This means equities will still be one of the best asset classes to put your capital to work and we should use the drop in share prices as a buying opportunity.

However, I think we will see a rotation out of high price-earnings (P/E) stocks, such as CSL Limited (ASX: CSL) and Afterpay Touch Group Ltd (ASX: APT) into value stocks that are trading below their historical and market P/Es. This may already be starting as these premium stocks have copped a big beating.

The bull party may end in 2019, but we'll worry about that in the new year.